Picture archiving and communications systems (PACS) are capable of finally realizing the full potential of digital modalities, and facilities are finding PACS an indispensable component of their technological toolkits. Most important, PACS is proving to be an important strategy for keeping physicians efficient and happy, as well as providing a new revenue source for multispecialty practices.

However, suppliers and industry observers alike warn buyers that investing in PACS not only involves a substantial capital outlay, but a long-term commitment in terms of time, people and most importantly, information technology savvy.

The ability to digitally store and transport radiological images, as well as patient information, is by itself a major justification for a PACS investment today. PACS allow facilities to not only save money in space, film and full-time equivalents but also generate additional revenue through increased throughput and physician referrals. Most importantly, a PACS investment allows for faster diagnoses. “Digital tools are helping radiologists make better reads and are helping to provide improved patient care, enhanced efficiency and reduced costs,” Tim Law, president of Salt Lake City-based NovaRad Corp. told Outpatient Care Technology (OPCT). “Radiologists are not delayed by waiting on old studies to come from a library for comparison. Techs are not waiting on film processors. The department can eliminate the huge expense in wet processors with their maintenance, chemistry, and repair. Overall, the radiology department can produce more at a lower cost using PACS.”

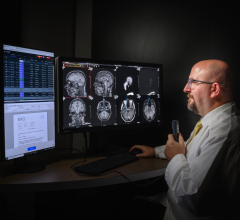

Because digital images can be viewed from virtually anywhere and at any time, PACS helps radiologists work more efficiently, a key benefit given today’s shrinking radiology workforce.

Going Soft on Hardware

Buyers in the outpatient care arena are more than ready to take advantage of PACS now that it has shown what it can do on the acute care side. Noted Bryan Poteet, vice president, Sales and Marketing for New Orleans-based Avreo Inc., “The big boys in the hospital arena played with these toys for years. Now, the outpatient guys want to play.”

Added Daniel Giesberg, president of Hawthorne, CA-based American Medical Sales, “Outpatient care users are beginning to understand that moving to a digital imaging future makes sense from both a financial and workflow prospective. The issue is for how much, with whom, and in what steps.”

And their wish list is extensive, say suppliers with whom OPCT spoke.

“Buyers in the outpatient arena are a complex group,” said Law. “Each decision maker has their own idea of the basic features they seek. Administrators want to lower costs and still provide quality patient care, as well as eliminate the need to buy, process and file film. IT professionals want to know how much the system will impact their daily workflow, and whether routing large medical images will disable their network. A radiology director may be interested in how to improve efficiency, the integrity of the information and how difficult is it to correct data mistakes entered along the way, and how well images are flowing to the radiologists, including the capability for referring physicians to remotely access patient images and reports. The radiologists also want quick turnaround and they don’t want a PACS system to slow them down.” Bottom line: A PACS should support streamlined procedures that make the outpatient clinics more efficient.

Observers argue that in many ways, PACS hardware has almost become a commodity. The key differentiator among suppliers today is the software – and the support after the sale.

Indeed, system software today has revolutionized PACS. “In its early days, the PACS industry had an image bucket mentality,” observed Poteet. “Today, it has matured into a sophisticated information system.”

As sophisticated as PACS software has become, it still must accomplish the basic goals of any outpatient care provider. “Ultimately, the basic features of the system affect the patient experience. You get in, you get imaged, you get your result,” said Bob Cooke, executive director Marketing-Network Systems for Stamford, CT-based Fuji Medical Systems. “Today's competitive outpatient environments compete on service. A good PACS system should facilitate business and clinical goals without sacrificing either. The quality of patient experience is second only to the quality of the diagnosis. Radiologists need the confidence that they have the tools and the information to render and produce a quality, consistent and clear result.”

Added Giesberg: “Outpatient customers are being bombarded with advertising about 3-D imaging, virtual this and that, PET/CT fusion and Web viewing, but the system features for most end-users are more practical. They include user intuitive workstations, easy connectivity to modalities and safe online storage with reliable and easy-to-use backup.”

Technological Wish List

That said, here’s a look at some of the most important features buyers want in their PACS setup.

Web-enabled solutions. Web-based technologies have reached a point of sophistication that allows for the transport of huge data files to virtually any computer that has a high-speed Internet connection. To many observers, this is the Holy Grail of PACS’ promise: the ability of radiologists to view scans within minutes, and share their results quickly. “In the outpatient market, everyone wants a Web-based solution,” said Poteet. “There’s a shortage of radiologists and Web-based solutions are much easier to deploy, especially among multispecialty organizations.”

In recent years, there’s been a shift toward Web-based PACS packages, especially in the outpatient care arena,” noted Brad Levin, vice president of Marketing for Allendale, NJ-based Dynamic Imaging. “The reason is they need flexibility and scalability. Clusters of commonly owned imaging centers need this kind of distributed regional solution.”

Legacy PACS, most of which were client server-based, required facilities to know in advance where their radiologists would be, according to Levin. “With Web-based PACS solutions, it doesn’t matter where your docs are,” he said. “A user ID and password is all they need.” Levin added that Web-based PACS enable radiologists to access modeling tools wherever they are. Furthermore, true Web-based solutions allow docs to access “the same database of images, the same archive and the same toolsets,” he said.

Flexibility and scalability. Given the widely variable nature of the outpatient market, PACS need to be flexible and scalable. Said Giesberg, “Customers are demanding expandability in both size, such as archive or workstation growth, and function, including the knowledge that their PACS vendor will be there to support them when they need more complex software or connectivity to an electronic medical record [EMR] or radiology information system [RIS].” Levin noted that flexibility is a key attribute outpatient imaging centers are looking for in PACS because it allows for an important additional revenue stream. “Outpatient settings are calling for flexible models that adapt to their customer base,” he said. “For example, larger practices with multiple sites will buy PACS with the intention of selling their expertise and server capacity to other entities such as hospitals.”

Compatibility. Integration issues are one of the biggest thorns in the side of any PACS administrator, and suppliers are taking lessons learned on the hospital side and applying them in the outpatient market. “Integration with non-PACS clinical tools is becoming increasingly important as applications such as MDCT and PET/CT fusion are emerging,” said Cooke.

“Today’s best PACS systems are powerful management tools if they incorporate all of the features of the older radiology information systems,” added Poteet. “Customers are demanding integration of PACS with RIS, EMR and practice management tools. Separate interfaces can be expensive.” The bottom line, according to Poteet is this: “PACS systems must address all aspects of the patient visit, including billing, documents and images. A good example of this is resolving the ordered exam with the actual performed exam to ensure proper payment. This allows a facility to run management reports and audit trails across one application, not two.”

Ease of use. Time is at a premium these days, and the easier a PACS is to use, the greater the chance of its acceptance. “Radiologists want control over their workflow, how screens appear, how screens interact with each other, how easy it is to manipulate the images in the way they need to,” said Paul Berthiaume, a spokesman for Westwood, MA-based Medical Information Technology Inc. (MEDITECH). “What that requires is a seamless integration with their RIS. As providers, they don't care about the how’s and why’s that is accomplished. Vendors need to make sure that the RIS/PACS integration is seamless, in order to achieve the desired results in their workflow.”

Cooke differs on the usability factor. “Ease of use is a term that is often over used,” he said. “At Fuji, we designed our software application to be consistent with an operating system and conventional consumer software applications. These applications, while they may not be ‘easy to use,’ are familiar, and therefore, intuitive.”

Affordability. Suppliers with whom OPCT spoke were somewhat divided on the affordability contention. “Cost issues aren’t as big a deal as one would think in the outpatient arena,” said Levin. “We’re seeing very educated and well-informed buyers in the outpatient arena. Centers that have aging PACS systems and are looking to replace them are usually very astute about their needs. They don’t want to skimp on features. Their biggest needs are usability and overall value – not cutting costs. Facilities realize that in order to keep their radiologists happy, docs need to be able to access images on their terms.”

Meanwhile, others maintain that cost is an important factor with many outpatient providers. “In the outpatient setting, there’s lower volume so affordability becomes important to many buyers,” said Mark Schwartz, president and CEO of Pewaukee, WI-based IMCO Technology. “Outpatient customers are looking for less sophisticated features than hospital customers.”

Poteet agreed. “The outpatient market is still price-sensitive with PACS. Our prospects are looking for a cost-effective Web-based tool set to address their radiology workflow requirements. Most facilities want to minimize the capital outlay to deploy the technology while still be able to reap its operational benefits.”

But Levin added that Web-based PACS “simplify the cost of ownership for outpatient care centers, especially when scalability is needed, because fewer servers are needed to make it work.

Advanced features. Most suppliers agree that outpatient buyers are interested more in practical features than the proverbial bells and whistles. “In our experience, buyers want what saves money and gets more work done,” said Berthiaume. That said, the list of advanced PACS features is long, but some of the more popular ones include tools that allow radiologists to take advantage of molecular and 3-D imaging. “As data sets become more and more complex, tools such as advanced 3-D capabilities and sophisticated applications to assist radiologists in decision-making are increasingly important,” indicated Eric Pearce, manager, Americas Marketing for Mount Prospect, IL-based GE Healthcare’s Information Technologies unit. Levin said the most popular advanced features include orthopedic templates and 3-D and advanced visualization tools embedded into the software’s user interface, which not only saves money, but also obviates the need for dedicated workstations.

Implementation Caveats

Evaluating and purchasing a PACS is almost secondary in importance to understanding what is involved in actually getting the system up and running within your enterprise, according to a variety of observers and suppliers. There are myriad issues to consider, including: work environment considerations; whether an existing network can handle the huge data transmission and storage demands; security and confidentiality concerns; how modalities will interface, if older patient information and digitized images are compatible; and perhaps most important, how well, if at all, an existing RIS and EMR system will integrate.

What’s at stake?

Managing expectations. Many PACS buyers enter the process with unreal expectations, many of which haven’t been managed internally before going to market. For many facilities, a successful PACS implementation involves keen political skills on the part of administration. “For some, usually older radiologists, it is a significant transition to move from a lifetime of paper and film-based processes to a new world of digitized images and doing everything online,” said Berthiaume. “We have found that it's imperative to get those radiologists on staff who have made the transition to help teach those who have not.”

One of the biggest false expectations involves time. A “typical” PACS installation, if there is such a thing, doesn’t happen overnight. “Customers also are demanding quick installation,” said Poteet, whose company boasts a complete PACS deployment in 30 days or less. Many PACS installations, however, can take months and even a year.

Environment and ergonomics. Suppliers say many buyers spend too little time considering the investments needed for making a suitable PACS environment. Levin said such considerations should include soft copy reading accommodations, spotlighting (and elimination of fluorescent lighting), ergonomic furniture such as high-back chairs and proper air circulation in reading rooms. “As the PACS environment shifts increasingly towards smaller scale and outpatient imaging environments, the readiness of the environment for a digital solution can be a challenge,” added Cooke. “Space, networks, and reading environments all need to be evaluated before a successful implementation of a PACS system. It makes sense for buyers to work with experienced vendors, as the ultimate cost of the system will depend on how quickly and effectively it can be implemented.”

In-house IT expertise. Observers say there is a dearth of IT talent in the outpatient market – a factor many buyers fail to consider when getting into PACS. “The IT infrastructure inside many outpatient facilities is sometimes an afterthought,” said Levin. “Many practices just have an office administrator and two or three radiologists. There’s a very aggressive expectation among customers but no backup in terms of local IT expertise. Customers considering a new PACS purchase need to consider the resource load for every level of support.”

Added Giesberg, “Smaller facilities do not have the IT staff support that one would expect in a larger facility. In these facilities you find either contract services or self-trained staff. Systems must be simple to use and easy for the internal people to train their own staff. Because of this, a well-trained distributor and an end-user that allocates the time for personnel training is essential.”

Commitment to industry standards. A successful PACS implementation also entails a firm commitment to industry standards, suppliers noted. These include DICOM-ready capability, Integrating Healthcare Enterprise (IHE) standards, which were established to make integration issues go smoothly, and Portable Data for Imaging (PDI) standards, which enable any computer system to view and import original scans burned on a compact disc. “PACS suppliers that don’t incorporate PDI capability will cause a lot of unnecessary re-scans and waste if a patient comes to a hospital with a CD of scans burned by a non-PDI-compliant system,” said Levin.

Pearce indicated that one of the biggest PACS implementation challenges today is interoperability, and the resistance on some vendors’ part to embrace standards. “Some vendors continue to use proprietary systems, making interoperability difficult, expensive and unstable, and ultimately keeps systems isolated,” he said.

Assuring Smooth Integration

For many facilities, a PACS investment is wasted if it fails to integrate smoothly with existing systems such as RIS and EMR. “Integration with non-PACS clinical viewing and analysis tools is emerging as a new kind of challenge,” said Cooke. “There are no standards for these types of viewer integrations, and as a result, many end up being custom work, with a mixed success in terms of performance and outcome.”

Giesberg, on the other hand, warned buyers to avoid integration pitfalls. “Some companies are less than willing to provide a fully integrated PACS solution at the right price,” he said. “Many are just souped-up workstations that offer only temporary solutions an outpatient facility will outgrow in a short while. Smaller users in the outpatient arena may not be buying what they need. If it's a PACS system that's not upgradeable, they're wasting time and money.”

November 29, 2025

November 29, 2025