The world market for artificial intelligence (AI)-based clinical applications for use in medical imaging is set to reach almost $1.5 billion by 2024 despite a slower-than-expected uptake of these products and the impact of the COVID-19 pandemic. This is according to a new report from Signify Research, an independent supplier of market intelligence and consultancy to the global healthcare technology industry. The market growth is projected to accelerate as the pandemic subsides and customer confidence in AI-based clinical solutions increases, with a peak annual growth rate of 44% forecast for 2022.

This market is comprised of software solutions for automated detection (including triage), quantification, and classification of radiology findings. Growth has been less rapid than many industry experts anticipated due to several technical and commercial barriers and has been further set back by the COVID-19 global pandemic. These barriers to market adoption, including the utility of AI in clinical practice, a lack of clinical validation, the challenges of workflow integration, and limited reimbursement, must be fully addressed before the use of AI in radiology becomes mainstream.

However, Senior Analyst at Signify Research, Sanjay Parekh, Ph.D., remains optimistic. “The market is highly dynamic and continues to evolve at a rapid pace,” he commented.

“There are frequent product launches, and the availability of regulatory approved products is accelerating. Since 2018, almost 60 AI-based clinical applications for medical imaging have received US-FDA approval, while a similar number of solutions have received CE Mark approval.”

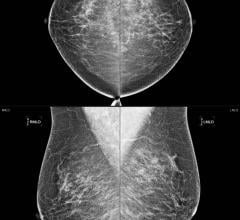

The Signify Research report found that in 2019, 86% of the world market for AI-based clinical applications for medical imaging was accounted for by four clinical specialities: (in order of market size) cardiology, neurology, breast and pulmonology. Cardiology is forecast to enjoy the largest revenue growth, followed by pulmonology, and these four clinical segments are projected to still account for more than 75% of the market in 2024. However, new product introductions of AI solutions for other clinical segments, most notably prostate and liver imaging, are on the rise.

Despite the many challenges of bringing medical imaging AI solutions to market, Parekh emphasised that “radiology AI is here to stay.”

“From enhanced productivity and increased diagnostic accuracy, to more personalised treatment planning and improved clinical outcomes, AI will play a key role in enabling radiologists to meet the demands of their workload. The increasing volume of diagnostic imaging procedures, exacerbated by the current backlog of imaging exams due to national lockdowns, coupled with the shortage of radiologists in many countries, will undoubtedly further increase the need for AI in radiology,” he concluded.

Sanjay M Parekh, Ph.D., is a Senior Market Analyst for Signify Research, an independent supplier of market intelligence and consultancy to the global healthcare technology industry. For more information: www.signifyresearch.net

August 29, 2024

August 29, 2024