Return on investment (ROI) is an important consideration for any capital equipment purchase, and that includes information technology (IT). All too often, healthcare facilities view IT investments such as PACS with one eye open – decision-makers examine the costs savings, but don’t take into account the impact of new business opportunities.

Take the cost of film, for example. Look at the cost implications of a total film-based or digital-based radiology department. Based on the assumption that all other costs are equal, as procedure volume increases, total operating costs increase at a greater rate in a film-based environment than in a digital-only environment. These total costs intersect at 50,000 procedures.

So does that mean that facilities under 50,000 procedures will not incur an ROI on PACS?

“PACS has become a necessity for any site with an MRI or CT scanner that generates thousands of slices with each study,” said Henri “Rik” Primo, director of marketing and strategic relationships, Siemens Medical Solutions. These studies would be very difficult to review and more costly to produce with film, he adds.

“Breaking even with PACS is not a difficult proposition today if one includes the total cost of film, folders, processing and a second copy of the data,” indicated Michele Fisher, president, BRIT Systems. “PACS should be a part of the ROI for advanced imaging systems such as 64-slice CT. You just can’t do these studies any other way than digital.”

PACS is not only a necessity, but it is imperative to keeping up with the shortening life cycle of modalities and to automate workflow, commented Hossein Pourmand, vice president of Business Development at Candelis. “Today’s challenge is to increase efficiency and revenue,” said Pourmand, even in an era of decreased reimbursement for imaging procedures.

“It’s no longer a question of whether or not facilities will experience a return on investment when implementing PACS. It’s a well-known fact that PACS provides significant ROI. The question is who do you trust with your investment, who can help you attract top quality radiologists and who can bring you the technology that will carry you into the next generation of imaging technology,” said Vijay Tanjore, marketing manager, GE Healthcare.

Most, if not all, newly built facilities are filmless, Fisher points out. “Facilities need a PACS to remain competitive and be considered a modern facility that provides immediate access to patient data,” she said. “It’s required to integrate with electronic medical records.” Indirect benefits such as increasing patient safety and reducing medical errors should be taken into account when considering PACS implementation.

Total cost of ownership

One of the most important considerations for any new or replacement PACS purchase is total cost of ownership (TCO). Recouping TCO will take four to five years for a complete, new turnkey system and theoretically, less for replacement PACS.

Beyond the upfront cost of PACS, facilities must include the cost to maintain and configure the system. “Multiple FTEs will eat into ROI. Find out the characteristics of the PACS and how to decrease those maintenance costs,” Pourmand suggested. He also recommends seeking a scalable solution that can grow with the facility. “Information Life Cycle Management is very important, particularly since the cost of this technology decreases over time,” Pourmand added. He believes that scaling the archive can help reduce the cost of storage over time.

Fisher encourages facilities to closely examine disaster recovery and business continuance. “How will you stay operational if your system goes down? Does your PACS vendor provide this and to what extent?” she asked. “We don’t just talk about images anymore; we talk about how a user will get immediate access to the data and how the department will remain operational.”

Pourmand points out that “[f]acilities that implement today can learn from the early adopters and benefit from technological innovations.”

The differences between buying a first PACS versus a replacement PACS is similar to the first time homebuyers versus experienced homebuyers, according to Tanjore. A first-time homebuyer looks for four walls and a roof, while experienced buyers consider the neighborhoods, schools, updated appliances and more. “Second- time PACS buyers have more experience, a better understanding of what they need and don’t need and therefore may be willing to invest more time and resources into a product that can really meet their needs this time around,” said Tanjore.

A key consideration for many replacement customers is the ability to integrate with existing or planned future systems, says Tanjore. “Technology has changed and facilities expect that their replacement PACS will interface with clinical systems, laboratory and the EMR,” he said. Buyers must understand how PACS work with other systems.

Another issue is the availability of advanced clinical toolsets via single sign-on for clinicians and referring physicians. He suggests that facilities determine if “the system provides the complete context of the application – whether it is CT, mammography or nuclear medicine applications – on one workstation.”

Third, Tanjore believes intangibles such as report turnaround time are critical elements for any replacement PACS implementation.

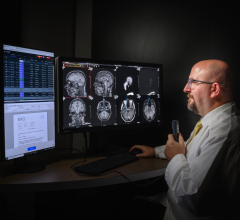

Primo agrees that PACS is an ideal opportunity to re-engineer workflow in the context of digital imaging that will better serve referring physicians. “This translates to better care and possibly, more referrals,” he said. Today’s workflow must be seamless, from patient registrations to report delivery, he adds.

Delivery of the images and reports to the referring physicians should also be reviewed, Primo explains. When considering the needs of referring physicians, don’t forget those who work within the facility, such as emergency medicine, orthopedic surgeons or neurosurgeons.

Also examine how you plan to pay for PACS. “Are you buying, leasing or using an ASP model?” asked Fisher. “What is your CFO giving you credit for?” She points out that Critical Access Hospitals are reimbursed by the U.S. government based on costs. “What is it costing, and what benefits are they receiving?” This is an important consideration when evaluating a PACS that costs $4 per study versus one that costs $6 per study. “The differences – sophistication, integration and data integrity – will pay you back every day. The additional costs of bad data integrity will continue to cost money, long after you’ve been paid for that exam.”

Adherence to standards

Vendors who follow DICOM standards and IHE profiles not only help propel system integration, but also provide options to buyers. “If you select a vendor who adheres to DICOM standards, then you have full flexibility to choose the best of breed for systems and workstations,” said Pourmand. He also notes that this can keep costs low because so much of the hardware today can be bought off the shelf.

Delivery of images throughout the enterprise is also simplified with compliance to standards. Primo added, “With the IHE PDI profile, clinicians can read any image off a CD or DVD on their own viewer.”

Implement HL7 interfaces upfront, recommends Fisher. “Without them, the data stored can be of low data integrity. As the U.S. government initiative for electronic medical records becomes more prevalent, your facility will be well prepared.”

Prepare for data migration

It is no longer a matter of if data will migrate, rather, when and to what extent. “Data migration is dependent upon the customer expectations,” explained Tanjore, “so follow the 80/20 rule to define how far back [in time] is necessary to access.” For example, 80 percent of the images the facility wants access to will comprise only 20 percent of the total records. The 20 percent can be determined by age of the study (the past six months), study (mammograms) or patient demographics (pediatrics).

“The archive should be the first component to install,” Tanjore said, “so the new vendor can start archiving current studies into the existing and new PACS.” He also recommends that vendors work with customers to help set data migration expectations to keep costs down.

According to Fisher, many sites are storing every image because they don’t yet know what they must keep for potential liability issues, leaving administrators wondering if all images need to be stored or just the post-processed images. “There is not a standard of care on what is to be stored from the 64-slice CTs,” said Fisher, “and soon these devices will produce even more images.”

Most often, problems with data migration occur because a legacy system has proprietary DICOM tags and headers, Pourmand explains. Even with this potentially higher cost for migrating data, he believes it is still more cost effective to implement a new PACS rather than continue paying the maintenance costs for an existing and often technologically outdated PACS.

Primo points out that some facilities moving to a new generation PACS with the same vendor may be able to avoid data migration altogether. “It is possible to copy an older database into a newer database, and we’ve been able to do that at Pomona Valley Hospital,” he said. Because Siemens’ legacy PACS has pointers to where the images are stored, that information was transferred to the new PACS implementation. “It contains the same meta data, so clinicians can still refer to and access an old image in the archive.”

Fisher agrees that facilities should examine all the costs involved with switching versus upgrading PACS. “The decision will likely depend upon the age of that first PACS and the sophistication of the upgraded applications from that vendor,” she added. “If it is a forklift upgrade, it might be less expensive to replace it with a system from another vendor.”

Negotiate to reduce downtime

PACS uptime is crucial to any ROI calculation. Downtime translates to lost revenue and potentially an increase in expenses, but it has wider implications if referring physicians or patients do not receive the quality of care they expect. Negotiate uptime guarantees and service contracts, as these “hidden” costs can quickly spiral out of control.

Review all licensing agreements and identify the full cost of upgrades and updates and the impact these have on your business model.

Lastly, include in your PACS ROI calculation the impact on the enterprise. Will it standardize and improve the delivery care? Can it help reduce the length of stay and improve clinical outcomes and patient safety?

Look to the future and extend PACS beyond the walls of radiology for an investment that can provide a return across multiple departments.

Feature | April 09, 2008 | Mary Beth Massat

ROI on PACS is more than digital vs. film, it involves the cost of data migration, implementation, maintenance and image accessibility.

© Copyright Wainscot Media. All Rights Reserved.

Subscribe Now

November 29, 2025

November 29, 2025