October 8, 2018 — Highly populated countries have traditionally been slow adopters of non-conventional business models, but a new Frost & Sullivan report says government initiatives to promote early tumor detection are expected to drive the use of X-ray mammography imaging solutions in these countries.

China and Eastern European (EE) nations such as Hungary and Poland are poised to be growth hubs for mammography solutions as their governments roll out organized, population-based screening. India and other countries in EE like Romania are still in the development phase. Vendors in these markets are strategically employing leasing, managed equipment services, and a variety of rental and pay-per-use models to boost procedural volumes. Additionally, new business models focusing on workflow efficiency will be the most feasible due to high budget deficits in these markets. At the same time, the evolution of payment models toward outcome-based reimbursement underlines the need for precision diagnosis.

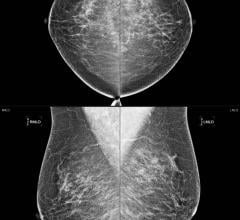

“Although analog and computed radiography (CR) mammography will continue to generate revenues from developing economies over the next three to five years, their increasing obsolescence will present considerable opportunities for 2-D digital radiography (DR) systems,” said Poornima Srinivasan, industry analyst, transformational health with Frost & Sullivan. "Studies show that digital breast tomosynthesis (DBT) is a game-changing technology for screening programs due to its ability to detect tumors in women with dense breast tissue. Similarly, 2-D DR mammography with 3-D DBT enhancement and synthesized 2-D imaging also offer high price-performance value."

Frost & Sullivan’s recent analysis, Global X-ray Mammography Imaging Systems Market, Forecast to 2022, analyzes various market trends such as the utilization of mammography systems, breast care statistics, mammography procedure volume analysis, and clinical layout of breast care. It covers growth indicators, growth strategies, competitive structure, and market share and revenues forecasts for North America, Europe and Asia-Pacific. The product segments covered include analog, computed, 2-D digital, 2-D digital to DBT upgrade, and digital breast tomosynthesis.

"To further improve product uptake, vendors are positioning 3-D with multimodality views, setting up workstations with 2-D and 3-D comparisons, and creating advanced detectors and algorithms to detect breast cancer at an early stage," noted Srinivasan. "Significantly, they are also launching technologies such as contrast-enhanced spectral mammography, which provides low-energy 2-D mammographic imaging on par with magnetic resonance imaging (MRI).”

Overall, the report indicates that vendors looking to expand their footprint in this market and monetize growth opportunities need to:

- Offer value-adds through additional software services and improve the value proposition for clinical and financial stakeholders;

- Realign care models to focus on painless patient comfort systems that standardize compression pressure with minimum radiation dose;

- Deliver a fully integrated solution that provides access to medical imaging data as telemammography consultation gains currency;

- Introduce technologies focusing on microcalcifications and breast density assessment; and

- Collaborate with radiographers, medical physicists and radiologists.

With technology developments in dose reduction, optimization, specificity, and sensitivity for early tumor detection, mammography will continue to be the preferred imaging tool for breast cancer detection.

For more information: ww2.frost.com

July 29, 2024

July 29, 2024