August 10, 2009 - Merge Healthcare Inc., a health IT solutions provider, and Confirma Inc., the largest privately-held developer of computer assisted detection (CAD) software for medical imaging, have entered into a definitive agreement for Merge to acquire Confirma in an all-stock transaction, the total value of which is estimated to be $22 million.

This acquisition brings Confirma’s technologies to Merge’s multiple market channels and international markets in a move to open computer-aided detection (CAD) imaging technology for the global healthcare market.

According to Michael Middleton, assistant clinical professor of Radiology, University of California San Diego Medical Center, “The long-term opportunity for CAD in diagnostic imaging is to contribute significantly to the reduction of healthcare cost, while increasing access to patient care and life saving modalities. As imaging studies grow in size and complexity, measured deployment of CAD and workflow enhancing algorithms for radiology show great promise to accomplish these goals.”

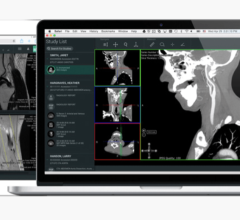

Confirma has spent years developing the extensive CAD algorithms, intellectual property and validation required of these highly technical clinical tools. The flagship product, CADstream, has over 1,200 systems implemented for breast and prostate MRI, and several additional solutions are in development. “Our customers understand the core benefits of CAD as a clinical workflow tool,” says Wayne Wager, CEO of Confirma. “By combining our patented CAD applications with Merge’s broader health IT solutions and global presence, we can better take advantage of current and future growth opportunities and, thus, extend our solutions to more clinicians.”

The all-stock transaction will be based on a 10-day volume weighted average price (VWAP) of Merge Healthcare’s Common Stock, as of the third trading day prior to the closing date and is subject to certain adjustments. The total value of the transaction is estimated to be $22 million or approximately 5.6 million shares of Merge Healthcare Common Stock using a ten-day VWAP as of the close of market on August 6, 2009 of $3.897. Based on these amounts, it is estimated that Confirma investors will own approximately 8.5 percent of MRGE post-acquisition. Merge expects the transaction to be completed in September.

For more information: www.merge.com

February 01, 2024

February 01, 2024