February 22, 2010 – RIS/PACS maker Merge Healthcare Inc. said today it is making a bid to purchased the PACS company AMICAS. However, Amicas says it already entered into a merger deal with another company.

It its sixth proposal to purchased AMICAS, Merge said it has a pending $6.05 cash per share offer for AMICAS, totaling about $248 million. This represents a 13 percent premium to the previously announced offer for AMICAS from a newly formed affiliate of Thoma Bravo LLC for $5.35 cash per share.

In amended proxy materials filed today with the Securities and Exchange Commission, Amicas disclosed it received an unsolicited proposal from Merge Healthcare. Merge's highly-conditional proposal is dependent on third-party financing, subject to a "reverse break" fee, which essentially gives Merge a $10 million option to buy AMICAS; subject to a number of additional conditions, the satisfaction of which are within Merge's control, and has been characterized as Merge's "best and final" proposal. Given the highly conditional nature of Merge's most recent proposal, the AMICAS Board of Directors believes that the Merge proposal is illusory and risky to AMICAS stockholders. AMICAS said the Merge deal would also require it to terminate the Thoma Bravo merger and pay the break-up fee of $8.6 million, which AMICAS doubts it would recover from any deal with Merge.

As previously announced on Dec. 24, AMICAS entered into a definitive merger agreement with Thoma Bravo LLC, under which an affiliate of Thoma Bravo would acquire all of the outstanding shares of AMICAS for $5.35 per share in cash. This purchase price is fully financed and guaranteed by Thoma Bravo and other first tier private equity funds and is not dependent on unguaranteed, third-party financing. AMICAS said Thoma Bravo was ready, willing and able to close the transaction on its originally scheduled closing date of Feb. 19, 2010. AMICAS said the Thoma Bravo merger provides AMICAS stockholders with immediate and certain cash value. AMICAS is confident that the Thoma Bravo Merger can be completed in a timely manner immediately following stockholder approval at the special meeting of stockholders scheduled March 4.

AMICAS said it has been advised Thoma Bravo remains fully committed to the transaction.

The AMICAS board and management team actively engaged with Merge and its advisors in an attempt to negotiate a transaction that is in the best interest of AMICAS' stockholders. But after carefully reviewing Merge's most recent proposal, the AMICAS board, consulting with its independent financial and legal advisors, determined the proposal is not a in the best interests of the company. The company said Merge failed to provide sufficient financial guarantees and reasonable protections for AMICAS stockholders.

Merge’s current offer follows its offer of $6 cash per share. The offer was made during the 45-day "go-shop" period in the deal with Thoma Bravo. The period ended Feb. 7, but allowed AMICAS to solicit and negotiate alternative proposals.

Merge intervened in Massachusetts litigation challenging the adequacy of AMICAS’ disclosures relating to this transaction, as well as the process by which its proposals have been considered by the AMICAS Board of Directors.

Merge said it received a signed bridge financing commitment from Morgan Stanley to provide $200 million of debt financing. Based on that commitment and available cash, including $40 million of prefunded equity investments from mezzanine investors, Merge has proposed to commence a $6.05 cash per share tender offer for all AMICAS shares and to close the acquisition as quickly as possible thereafter.

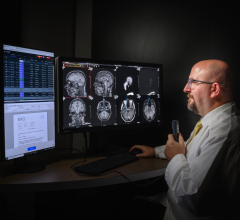

Merge develops solutions that automate healthcare data and diagnostic workflow to enable a better electronic record of the patient experience, and to enhance product development for health IT, device and pharmaceutical companies. Healthcare providers, vendors and researchers use merge products, ranging from standards-based development toolkits to sophisticated clinical applications.

AMICAS is a leading independent provider of imaging IT solutions. It offers image and information management solutions, including radiology PACS, cardiology PACS, radiology information systems, cardiovascular information systems, revenue cycle management solutions and enterprise content management tools designed to power the imaging component of the electronic medical record (EMR).

For more information: www.merge.com, www.amicas.com

November 29, 2025

November 29, 2025