December 29, 2014 — The market value of mammography systems in the Americas will increase from approximately $390 million in 2013 to $1.1 billion by 2020, according to business intelligence provider GBI Research, driven primarily by the uptake of 3-D systems in the United States and healthy demand for 2-D systems in Canada, Mexico and Brazil.

The company’s latest report states that the United States will continue to hold the dominant share, with its overall market value forecast to exceed $925 million by 2020.

Furthermore, U.S. 3-D systems revenue will rise from $99.2 million in 2013 to just over $757 million by 2020, representing a compound annual growth rate (CAGR) of 34 percent, while 2-D systems sales will decline at a negative CAGR of 4 percent.

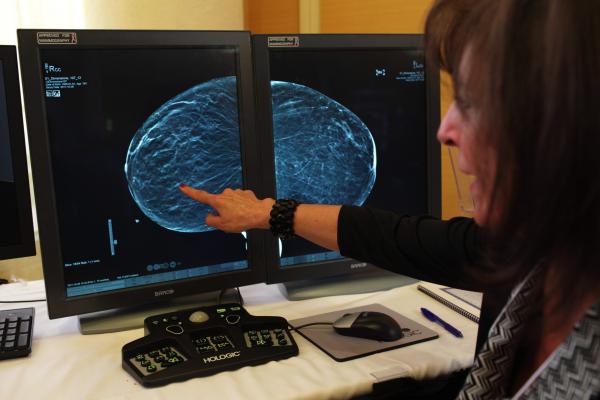

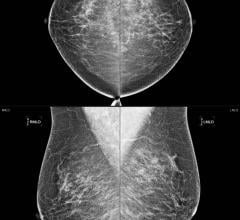

Srikanth Venkataraman, senior analyst for GBI Research, says: “The remarkable expansion of the U.S. market will be caused by continuous replacement of 2-D systems with 3-D systems.

“The rapid adoption of 3-D systems in the United States is due to technical advantages, such as improved breast cancer detection rate, the ability to handle higher procedure volumes and a more favorable reimbursement scenario.”

U.S. sales of 3-D systems will increase year-on-year during the forecast period and will overtake the falling 2-D market in 2016. The gap will continue to widen thereafter, although the U.S. 2-D space will still be worth over $168 million by 2020, more than the entire Canadian and Mexican mammography markets combined.

GBI Research forecasts that Canada’s share will rise from $23.7 million in 2013 to $78.9 million by 2020, at a slightly faster rate than the United States, while the Mexican sector will expand from $14.8 million to $33.3 million over the same period. The Brazilian market is expected to more than triple from $14.9 million in 2013 to approximately $47 million by 2020.

Venkataraman explains: “Strong demand for 2-D systems will continue in Canada, Mexico and Brazil, as high upfront cost limits the adoption of 3-D systems in small hospitals and imaging centers with significant budget constraints.”

For more information: www.gbiresearch.com

July 29, 2024

July 29, 2024