August 20, 2019 — Boston Scientific Corp. announced the completion of its acquisition of BTG plc. pursuant to the previously announced scheme of arrangement. BTG develops and commercializes products used in minimally invasive procedures targeting cancer and vascular diseases, as well as specialty pharmaceuticals.

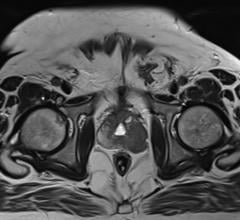

BTG has three key businesses, the largest of which is its Interventional Medicine portfolio. This encompasses interventional oncology therapeutic technologies for patients with liver and kidney cancers, as well as a vascular portfolio for treatment of deep vein thrombosis, pulmonary embolism, deep venous obstruction and superficial venous disease.

In addition to the Interventional Medicine product lines, the BTG portfolio also includes:

-

A specialty pharmaceutical business comprised of acute care antidotes to treat overexposure to certain medications and toxins; and

-

A licensing business that receives royalties related to BTG intellectual property and product license agreements.

Upon the effectiveness of the scheme of arrangement, BTG became a wholly-owned subsidiary of Boston Scientific, and BTG shares no longer trade on the London Stock Exchange. Under the terms of the previously announced transaction, holders of BTG common shares will receive 840 pence in cash per share.

Boston Scientific expects to complete the previously announced sale of its global embolic microspheres portfolio – comprised of Embozene, Embozene Tandem and Oncozene brands – to Varian Medical Systems Inc. in due course. The products in question are used to treat arteriovenous malformations and hypervascular tumors. This transaction was entered into in connection with obtaining the antitrust clearances required to complete the BTG transaction.

Read the article “Varian Purchasing Embolic Bead Assets from Boston Scientific”

In addition, the company is initiating a process to explore the divestiture of the royalty stream associated with BTG's Zytiga licensing arrangements and anticipates closing this divestiture by the end of 2019.

The transaction is expected to be immaterial to adjusted earnings per share in 2019 as a result of the BTG transaction closing later than originally anticipated, the divestiture of the Boston Scientific embolic microspheres portfolio, and the treatment of the licensing business as an asset for accounting purposes and its intended divestiture. The transaction is expected to be four to five cents accretive in 2020 on an adjusted basis, and increasingly accretive thereafter. On a GAAP basis, the transaction is expected to be less accretive, or more dilutive as the case may be, due to amortization expense and acquisition-related net charges.

The acquisition of BTG is the second interventional oncology-related acquisition by Boston Scientific in the last year. In October 2018, the company finalized the acquisition of Augmenix Inc., developer of the SpaceOAR hydrogel system to limit common and debilitating side effects of prostate cancer radiotherapy.

Read the article “Boston Scientific Closes Acquisition of Augmenix Inc.”

For more information: www.bostonscientific.com

July 25, 2024

July 25, 2024