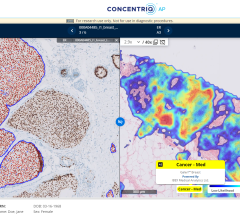

In this digital age it may come as a surprise that in one of the most advanced healthcare markets in the world, primary pathological diagnosis remains conducted by pathologists peering down the lens of a microscope.

Especially now, when artificial intelligence (AI) algorithms and advanced visualization techniques are increasingly making their way into radiology and cardiology, US pathology labs stand out as an unfortunate dawdler in digital adoption.

This progress is sluggish for several reasons (see Table 1), and while the COVID-19 fueled market uptick in 2020 acted as a boon for digital pathology vendors, core barriers previously inhibiting growth remained.

For the US market, two of the most significant barriers to adoption are highlighted above — and both revolve around the significant costs associated with digitization.

While single payer markets like Western Europe and the UK, Nordics and Netherlands established digital pathology networks and workflows via large-scale governmental funding and legislative aid, the US market has historically received no such support.

The Winds of Change are Present

Therefore, the recent announcement of new add-on CPT digital pathology codes has caused a stir. After many years of lobbying, recently the College of American Pathologists (CAP) successfully petitioned the American Medical Association (AMA) to create 13 category III codes.

Currently, pathology is reimbursed via a technical component (TC), professional component (PC) or “global” combination of the two. If industry speculation is to be believed, additional reimbursement would come in the form of an addition to the technical component of the review.

These codes will go into effect on Jan. 1, 2023, and while they currently offer no additional compensation, they do offer officials the chance to begin tracking and reporting the impact of digitalization.

In short, a very welcome first step toward eventual reimbursement.

It’s important to reiterate that Category III codes do not have an assigned relative value and therefore payments for these services or procedures are based on the policies of payors and not on yearly fee schedules. Category III codes also almost never receive national pricing from Medicare.

Is this Set to Blow Over?

This means that while reimbursement for digital pathology may be possible soon, it’s also not guaranteed. There are several unanswered questions remaining, such as how long will it take for payors to review the data accumulated by the codes, and are any more (for example Code I) being considered?

Crucially, the most important of these questions, how much reimbursement will be on offer, is yet to be answered.

Decision-makers should be paying close attention, as unless reimbursement is high enough to account for the significant costs associated with digitizing and maintaining digitized reviews, already financially constrained pathology services are extremely unlikely to take a leap of faith.

It should also be noted that this isn’t just inclusive of the running costs of scanners and equipment, but also storage — needs for which can accumulate quite quickly.

The Missing Piece: A Gateway for AI

Finally, some food for thought: as listed above, one of the core drivers for digital pathology adoption is the use of automated tools for measurement, which can have big impact on reading and reporting volume.

As mentioned, the US market differs from its western European counterparts in that several independent labs compete to outsource diagnosis. Chains like Quest Diagnostics, already keeping a keen eye on the digital pathology AI market, could use these tools to effectively out-compete turnaround times against its competitors.

Hand in hand, by generating additional custom, private providers may also adopt digital pathology workflows in lieu of slightly more conservative reimbursement.

And, while no CPT codes yet exist to measure the use of digital pathology algorithms, more and more are appearing across the hospital for use in radiology and other diagnostic related disciplines (cardiology, stroke care). It can even be argued that unlike in radiology, AI adoption may go together with the US digitization of pathology — primarily because it may become a key differentiator in throughput and revenue generation.

It’s notable therefore, that these new codes do not include reference to AI, perhaps indicating some pessimism in the industry and the nascency of AI in digital pathology today.

Overall: One Step Forward and Crucially No Steps Back

Pessimism and anecdotes on potential AI codes aside, recent enthusiasm is certainly warranted.

This is a significant step forward in a market that has arguably tiptoed for too long. And while there may be those who look at this move with cynicism, we believe that for digital pathology, the future is bright.

Now may even be a pertinent time to remind cynics that the initial emergency use waiver that opened up the US market has yet to be rescinded; and that above all else has signaled an optimism for digital pathology adoption not seen before from US regulatory authorities.

In short: the FDA, AMA and CAP are finally beginning to align, with sights set firmly on a digital future.

Imogen Fitt joined Signify in 2018 as part of the healthcare IT team. Since joining the team, Fitt has studied the breast imaging hardware and software markets, covering mammography, ABUS and conventional breast ultrasound on a global scale in addition to emerging technologies.

Related Digital Pathology Content:

Growth Projected for Digital Pathology Market Despite Challenges

The Collaborative and Diagnostic Benefits Digital Pathology is Delivering to Radiology

January 23, 2025

January 23, 2025