We don’t want to underestimate the impact that the Deficit Reduction Act (DRA) has had on outpatient and imaging centers, but the bigger story is that the DRA is just one component in an ongoing campaign by Medicare and other payers to try to control the burgeoning growth of imaging services. What is most notable is how other players in the imaging value chain are profiting from these imposed constraints.

The DRA and other measures, including recommendations from the recent Government Accountability Office (GAO) report and the payers’ utilization of Radiology Benefit Management (RBM) companies to “o.k.” a radiologists order are transforming the landscape of imaging in healthcare, not to mention the authority of the physicians.

To get a clearer picture of how medical imaging’s new scenery is shaping up, Imaging Technology News (ITN) spoke with analyst Scott B. Clay, senior principal, Center for Health Innovation, Noblis.

How has the DRA so far transformed the landscape of imaging in healthcare?

Scott Clay (SC): The hardest hit by the DRA are physicians in-office practices and local independent imaging centers. The independent imaging centers’ revenue base focuses on CT and MRI, which are the modalities most severely impacted by the DRA.

We are seeing a general belt tightening and a reduced cost base and capital spending around the industry. There is a ripple effect, and one of the downstream impacts is a slowdown in purchasing new equipment. GE, Siemens and other providers have seen a reduction in new equipment sales as they go toward refurbished machines.

There has also been a slowdown in the number of new entrants in the market, making imaging centers less attractive investment opportunities.

ITN: So is anyone profiting from the DRA?

As a result, we have seen more consolidation in the industry. The big national providers have touted this as a positive impact of the DRA because they have been able to weather the storm better and pick up smaller imaging providers at a lower cost.

The largest providers, Alliance Imaging and Ardent, have been on an aggressive acquisition track over the past year. Ardent listed 12 acquisitions with 40 imaging centers in the last year. Although national players have seen revenue cuts and had a negative revenue impact, they are more diversified so it’s not as painful for them.

With the smaller providers, disadvantages include a less flexible cost structure and inability to spread their costs and gain economies of scale and have more fixed costs. Also they don’t have diversified revenue.

When you look at national providers like Alliance Imaging, 80 percent of their business is wholesale revenue, and that is where they actually have mobile units that they contract out to hospitals. So 80 percent of their revenue was totally unaffected, and of the 20 percent that was retail, only a portion of that was Medicare. So because of their diversified revenue base, they were less impacted.

ITN: Has the DRA in any way benefited hospitals?

SC: Yes and no. We have not seen increased profitability in the hospitals, but we have seen less of a negative impact in hospitals.

Because the DRA is targeted to non-hospital reimbursement, it is viewed as an opportunity for hospitals. We thought it would lead to joint ventures with hospitals or hospitals picking up providers, and I think we have seen some of that. However, the hospitals did endure the negative impact that the providers and physician fee schedule had from the DRA. Hospitals have also experienced their own revenue constraints for imaging and other outpatient services.

The main provision of the DRA was to limit the technical component of reimbursement for centers that were reimbursed under Medicare the reimbursement fee schedule to the lower of the Medicare reimbursement fee schedule or the hospital outpatient perspective payment system. Hospitals continued to be paid on the hospital outpatient perspective payment system regardless of what the physician fee schedule was. The DRA in that respect did not target hospital payment.

If a hospital is going to do a joint venture with an imaging center or work with physicians to develop an imaging center, one of the considerations is what payment system should it be classified under within the two different payment systems - the Medicare physician fee schedule or the hospital outpatient perspective payment. You have to weigh the relative payment rate of those two systems against the constraints that you have working under those payment systems. For example, if you want to bill as a hospital outpatient service, it has to qualify under the regulations for that. It eliminates your ability to do a true equity joint venture with physicians.

ITN: What are other steps the federal government is taking to curb imaging costs?

SC: The DRA is just one of the initiatives that the federal government has taken to limit the growth of the burgeoning cost of imaging.

From Medicare or the federal government standpoint, they see imaging growing faster than any other component of healthcare. The DRA is one effort to try to impact that.

Just last month the Government Accountability Office (GAO) came out with a report that recommends to CMS to consider additional management practices to limit growth. The June GAO report said that imaging payments to physicians (on the Medicare Physician Fee Schedule) “more than doubled” or increased by over 100 percent between 2000 and 2006. According to that report, imaging payments to physician office settings (excluding hospitals and IDTFs) increased from $4B to $9B between 2000 and 2006 – roughly 125 percent. (All of these numbers reference imaging payments only, not overall payments to physicians.)

Imaging grew by 50 percent between 2000-2006 and of that 58 percent came from physician offices. Medicare payments to physician offices grew too. The real growth in imaging is coming from physician offices. So Medicare is looking for different ways to impact that growth. You can call it “DRA 2.” What they’re recommending is to institute measures for preauthorization.

For example, the recently proposed 2009 Medicare physician fee schedule rules suggest a physician in-office imaging would have to qualify for an IDTF (independent diagnostic testing facility). They did away with the 10.6 percent reduction, but this is a different provision of that rule. This is specifically for imaging itself. If you are a physician with a CT scanner in your office, today you don’t have to meet the criteria an IDTF has to meet. The criteria include a physician that qualifies to conduct that exam – this means a radiologist.

The bigger story is there is there is a continuing march by Medicare and other payers to try to control the burgeoning growth of imaging services.

ITN: Will this force manufacturers to lower their prices on capital equipment?

SC: When you have a maturing of the market, there is pressure on price and consolidation of providers, who will ultimately have more clout.

ITN: How will consolidation affect the value proposition for imaging as a service?

SC: Consolidation is a clear trend. What’s happening to imaging is there is a higher volume of imaging with lower profitability for the service.

What happens in those circumstances is you can’t afford be a single-site provider. However, if you are a multisite, sophisticated provider with a sufficient capital base, IT and good benchmarking on operations and strong marketing capabilities, then you will be able to succeed in that environment.

Recently, Novant Health (a not-for-profit integrated healthcare system serving North and South Carolina) acquired Medquest (a for-profit diagnostic imaging company) with 92 imaging centers. So a hospital bought an imaging company with 92 imaging centers. Still, we are going to see restraints on hospital reimbursements, and there will continue to be pressure on imaging since it’s such a rapidly growing service.

Private payers have been active in controlling costs. The value proposition for the Radiology Benefit Management (RBM) is they can reduce expenses more than they charge for their service. Does that improve overall access and quality of care? RBM’s are managing by excluding services.

What this industry is struggling with is an educational component directed at congress and to others. What the government is doing here is looking at silos, and only sees that imaging is growing faster. But they can’t correlate imaging for early diagnosis and prevention to avoid in-hospital expenses. This presents an opportunity for the industry to develop better measurement and educate the federal government and payers.

ITN: As imaging exams become the standard-of-care for diagnostics and treatment planning, could large volumes of imaging counter the reimbursement losses?

SC: The volume of imaging is projected to be strong, however, not as strong as before. MRI was growing at double-digit rates between 2000-2003 there were growth rates MRI at 12-15 percent. Now it is five percent growth. The growth rates for that modality have really dropped off.

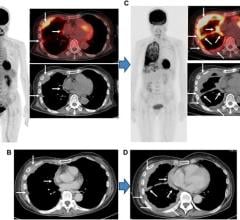

PET represents a smaller slice of imaging. It is now a rapid growth modality. It is also one of the modalities that the payers have targeted because they are concerned about the rise in cost from their standpoint.

So volume growth for imaging is projected to be strong, and while not as profitable, it is still a good business for some.

ITN: What do you predict the market will look like in five years?

SC: In five years, I see a continuation of the current trend. The writing on the wall from the government is this – they don’t like the growth in spending for ancillary services in physician offices and they have been more hands-off with the hospitals. They view hospitals and imaging as being a cash cow to support the ER and trauma services. The hospitals need these types of services to offset that kind of care.

There will be more consolidation toward larger imaging companies and a slowdown in the trend of providing imaging services away from the hospitals. Imaging services in five years will continue to move toward the profit level of other medical services, however, they will still be an attractive service for sophisticated providers who are in it for the long haul.

August 09, 2024

August 09, 2024