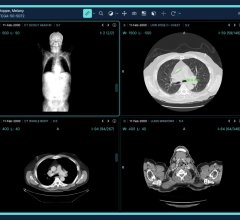

The deployment of AMICAS' Web-based Vision Series PACS was a key element of American Radiology Associates' teleradiology strategy.

With radiologists in short supply, the need for teleradiology services continues to grow and the market has responded in full force. Currently there are dozens of teleradiology vendors, ranging from large to small, covering the off-hour needs of hospitals and medical centers nationwide. Teleradiology affords even rural facilities without on-site radiologists the ability to offer 24/7 comprehensive radiology coverage.

Filling the Gap

For smaller facilities or those that cannot afford trained specialists, subspecialty teleradiology fills the interpretation gap in areas such as musculoskeletal (MSK), neuroradiology, cardiovascular and nuclear imaging.

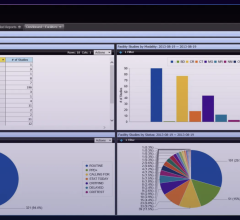

According to a Franklin and Seidelmann Subspecialty Radiology (F&S) 2006 study, 23.4 percent of radiology practice respondents stated that subspecialty coverage is a problem in their practices, reporting that current coverage levels for specialized interpretations are not at “appropriate” levels to support their clinician referrers’ needs.

“The shortage of skilled radiologists has lead to a significant shortage of subspecialized or fellowship-trained radiologists,” said Greg Rose, M.D., Ph.D, president and CEO of NightRays. “It is too much to ask one radiologist to be an expert on MSK, neuro, CTA, mammo, peds and nuclear imaging. Now that subspecialization is available by teleradiology, general radiologists can focus on bread and butter radiology and get support from an expert readily online. This eases the already increasing burden of the on-site radiologist and allows subspecialization to reach the patients in remote areas that cannot support a full-time specialist,” he explained.

Some vendors are, therefore, leveraging specialty services to remain competitive in the crowded marketplace. For NightRays, subspecialty reading is an integral part of its comprehensive, technology-driven teleradiology solution, while other providers devote its services solely to this specialized niche.

F&S is one such provider, boasting the only dedicated subspecialty network comprised of over 30 subspecialist radiologists.

When Kemp Laidley, owner of three freestanding imager centers — two in New Mexico and one in Texas — began shopping for a teleradiology provider, he was initially drawn to F&S based on word of mouth and the company’s reputation. But he quickly discovered that the Ohio-based provider offers more than subspecialty expertise. He was equally impressed with their tech support, IT support and marketing support.

The three centers outsource between 200 and 300 radiology reads per month in the areas of MSK, neuro and foot and ankle. Laidley says with F&S’ network, there’s never a lapse in coverage. They also do stat reads and are accessible by phone for the referring physicians.

Even when approached by other radiology groups, Laidley remained with F&S.

“We have not wanted to change [providers] because our referring physicians are so pleased with the service they receive,” he explained. “F&S provides quick turnaround on the reports with thorough and precise interpretations.”

Integrated Solution

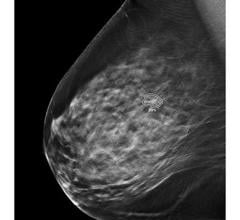

American Radiology Associates, P.A., Dallas, TX, is also committed to subspecialty interpretation. The large group practice boasts 53 radiologists, including nine dedicated to neuro studies, 10 to breast imaging, six to nuclear medicine/PET and five vascular interventional radiologists. The group relies on AMICAS’ Web-based teleradiology to serve its clients.

“We wanted a product that was truly Web-based, not simply Web-enabled. We examined several PACS platforms, but for us, the decision was pretty straightforward,” Craig Cunningham, American Radiology Associate’s managing director and chief operating officer said. “What made the most sense to us both from a PACS administration standpoint and a radiologist standpoint was the Realtime Worklist from AMICAS.”

The AMICAS Vision Series PACS is exclusively Web-based and the RealTime Worklist provides a completely

customizable, personalized paperless patient routing and internal communication system.

Many teleradiology service providers do not use PACS, according to Cunningham. Rather, they collect the images in another type of system and fax or email reports back to the customer.

“With AMICAS, we can supply the end-user access to not only the images they send us — via the AMICAS PACS platform — but we also imbed the report in the data set. That means that no matter where they are, the client can pull up their patient’s images, see the report and have access to the radiologist who actually reads the report,” he explained.

Cunningham strongly believes in the use of technology in deploying subspecialty care, which is why American Radiology Associates purchased a PACS platform. “It requires a lot of planning and capital to get started, but the end result is definitely worthwhile,” he said.

Proceed with Caution

The continued growth of electronic technologies that allow for global image transfer has created both opportunities and risks for radiologists and can have a significant impact on patient care, cautioned RSNA 2007 opening session presenter, James P. Borgstede, M.D.

“My challenge to radiologists is to advance the specialty, rather than allow it to become a commodity and radiologists become employees of a regional, national or multinational business,” Dr. Borgstede said.

Although the American College of Radiology requires that teleradiologists be licensed in the states in which the patient is receiving care, there is no national teleradiology association governing teleradiology. That leaves a wide margin for interpretation among service providers.

“Those who believe all or most radiologists and teleradiology services produce the same product with the only differentiator being price and choose their service based on this approach indeed commoditize radiology,” said Dr. Rose. Companies that provide as little substance as possible to generate the highest margins possible are prime examples. However, Dr. Rose points out, clients who differentiate radiology services based on the quality and breadth of their offerings, such as accuracy and completeness of reports, standards of care, clinician interaction, research and development and respect for the on-site radiologist do not commoditize the specialty because they do not simply distinguish services based on price alone.

New Reading Paradigm

Teleradiology is more than just reading an image and creating a report in a cost-efficient manner. To build value in teleradiology, it should enable clients to improve referring physician satisfaction, increase referrals, increase revenue and enhance patient care, while optimizing radiologist staffing costs through service and accountability to the patient, the clinician and the on-site radiologist.

Essentially, teleradiology has been based on preliminary read services. With these reads, the teleradiologist does not do a full read but turns the report around in a very short period of time, in some instances in less than 30 minutes. While there is tremendous value to a quick turnaround on a read, what threatens to commoditize teleradiology is outsourcing prereads to non-board certified radiologists, who may be less skilled than the U.S.-based radiologists, yet will do the read at a cheaper rate.

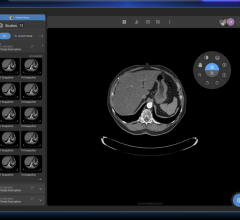

A new spin on read services, a consult preread, could either raise the bar on the quality of teleradiology or could stir up more competition. When Merge Healthcare launched its consult preread service at the last RSNA, they changed the outsourcing game once again. Although the concept may seem similar to the preliminary read - radiologists based in India does the read to help U.S. radiologists prepare their official, final diagnostic reports, the consult preread goes further, by performing a double read on each exam and generating a more robust report for the U.S. radiologist. The consult preread is designed to expedite the final read, not replace.

Merge describes the consult preread process in the following steps: a study is transmitted to the offshore reading center via Merge’s TeleRead solution; each study is then reviewed independently by two experienced radiologists who are trained to detect not only relevant pathology but also abnormal findings and pathology in anatomy adjacent to the regions of interest; the finished consult preread report and key images appear in the designated U.S.-based radiologist’s RIS or RIS/PACS-based work queue within minutes of completion of the consult preread; and the U.S.-licensed radiologist at the customer site then performs a complete, official final read and issues a signed report to the referring physician.

The difference here is a consult preread is the product of two separate reads sequentially processed by two different offshore radiologists, thus producing a single findings report. The report includes references to prior studies, relevant patient clinical information, extensive measurements of relevant and nonrelevant pathology and associated key images, however, the U.S.-based physician uses the consult preread report only as a foundation for creating a final read report. He or she may sign off on the preread as-is or may make revisions, then sign off.

In terms of quality, Merge emphasizes that upon completion of the final read by the U.S. radiologist, the medical imaging study has been triple-read before the U.S. radiologist sends it along to the referring physician.

Once again in teleradiology, the use of offshore radiologists creates new opportunities and risks for radiologists, which, as Dr. Borgstede warns, could commoditize the expertise of radiologists if not used with caution.

November 19, 2024

November 19, 2024