IBA's Proteus ONE proton therapy system.

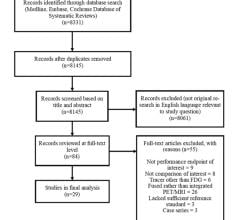

Proton therapy has been on the rise in recent years, both in the United States and abroad, with more and more proton centers opening their doors to cancer patients around the globe. It provides an attractive alternative to conventional radiation therapy, as the directed beam more intensely attacks cancerous tissue while sparing surrounding healthy tissue and organs. In addition, radiation oncologists can control the depth to which the proton beam penetrates, and the beam will not travel any further, unlike traditional X-ray-based radiation therapy.

As beneficial and attractive as this may seem, the reality is that, in the U.S. at least, less than 5 percent of all patients treated with radiation therapy annually receive proton therapy. To bring the situation into even sharper perspective, there are an estimated 2,100 facilities nationwide performing radiation therapy — and only 14 proton therapy centers fully operational.

Why the stark imbalance? The main reason is that proton therapy, as a clinical treatment, is still a relatively new concept — the first dedicated proton center in the U.S. opened in 1990, and before that the technology was primarily used for research purposes. Many of these early centers were built around massive proton accelerators, which require specialized beam transport systems to carry the protons to the treatment rooms. Because of the sheer size of the accelerator and the complexity of the system, building these proton centers has cost, on the low end, $125 million; the nation’s newest facility, the Scripps Proton Therapy Center in San Diego, which opened in early 2014, reportedly carried a price tag of $220 million.1

In its report “U.S. Proton Therapy Outlook 2017,” international market research firm RNCOS projected that the U.S. will house 27 proton centers by 2017. The National Association for Proton Therapy (NAPT) reports there are currently 11 new proton centers under construction nationwide, lending credence to RNCOS’ forecast. In total, those 27 proton centers are expected to collect a total revenue of $1.17 billion.2, 3

Worth the Cost?

Despite the bullish projections, the astronomical price tags currently attached to proton centers make achieving any kind of return on investment from proton therapy a dubious proposition. Many of today’s proton centers sport multi-room configurations, and according to NAPT, an average of 150-200 patients are treated per day. In contrast, the American Cancer Society projects there will be nearly 1.7 million new cancer diagnoses in the United States in 2015.4

As the number of proton centers nationwide continues to grow, the economic viability of this multi-room model has started to come into question. In December, the Indiana University Proton Therapy Center closed its doors after 10 years of operation. University officials cited numerous reasons for shutting down the program, including increased competition from other proton centers, outdated technology and declining reimbursement rates. “Unfortunately, rapidly advancing technology and changes in the dynamics of cancer treatment have left us with a dwindling patient base and a facility that is many times more expensive to operate than most of our competitors in this field,” said Jay Hess, M.D., Ph.D., vice president for university clinical affairs and dean of the

IU School of Medicine.5

The Next Frontier

Cases like Indiana University are the exception rather than the rule, but many in the industry believe that the costs need to come down drastically in order for proton therapy to remain a viable option for cancer patients. “It’s an effective modality, but the cost has been prohibitive,” said Joe Jachinowski, president and CEO of Mevion Medical Systems. “There’s just not that many institutions that can afford to take that kind of financial risk or have the resources to take it.”

Those types of places have traditionally been large teaching institutions, but Jachinowski and others are working to lower the size, the cost and the complexity of proton therapy to make it more accessible. “Everybody’s target is eventually going to become the community hospital,” said Stephen Sledge, vice president of marketing for ProTom International. “The industry trend is moving toward single-room and two-room configurations, so the technology has to get smaller.”

Mevion’s S250 system received U.S. Food and Drug Administration (FDA) approval in June 2012.6 The system utilizes a superconducting synchrocyclotron that is significantly smaller than traditional linear accelerators — 15 tons versus

22 tons — and operates similar to a traditional image-guided X-ray system. According to Jachinowski, the company can build a 2,000-square-foot proton “vault” for around $27 million.

ProTom International is also working to provide proton therapy in a smaller, more efficient package, and introduced the Radiance 330 system, which received FDA approval in March 2014.7 A modular design allows users to adapt the system to fit their needs, with orthogonal imaging and image registration software working in tandem to generate an automatic patient alignment correction vector. Fidelity beam scanning paints the tumor with the prescribed dose, and magnetic steering guides lateral dose deposition. Many of these new systems are designed for the single-room configurations mentioned by Sledge, coming in significantly smaller while still providing high-quality treatment.

Pencil Beam Scanning

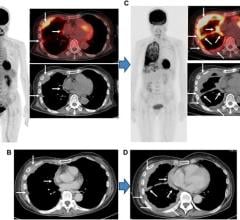

Proton therapy took another step forward in 2014 with the introduction of pencil beam scanning as the latest modality. Pencil beam scanning employs an ultra-thin proton stream guided by an electronic system to precisely target the tumor in three dimensions. This method is especially useful for treating irregularly shaped tumors near highly sensitive organs.

The pinpoint precision of pencil beam scanning has led to the practice of intensity-modulated proton therapy (IMPT), where radiation oncologists can attack a tumor layer by layer, adjusting the angle of the proton beam as treatment progresses to improve control of dose distribution.

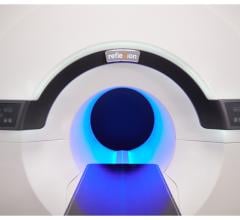

Several major vendors have already begun offering pencil beam scanning and IMPT commercially. Varian Medical Systems upgraded its ProBeam proton therapy system last year to allow IMPT,8 and Iba (Ion Beam Applications SA) offers similar benefits with its compact ProteusOne system.

Changing Landscape

The nationwide shift of the healthcare industry from a fee-for-service payment model to a value-based payment system presents another set of financial challenges. The Centers for Medicare and Medicaid Services (CMS) and other governmental organizations have begun adjusting reimbursement codes, eliminating some and bundling others together. And when it comes to reimbursement, proton therapy is already “twice as expensive as X-rays,” according to Jachinowski.

Part of the problem is that there have been so few treatment cases, relatively speaking. “Private insurers are saying they haven’t seen enough evidence yet that proton therapy is a better cure than traditional radiation therapy,” said Sledge.

As insurers and regulatory bodies work to parse the situation out, other parties have proposed solutions to the reimbursement dilemma. In an article published in the Journal of Clinical Oncology last May, two physicians at the Abramson Cancer Center, Perelman School of Medicine at the University of Pennsylvania put forth the idea of “reference pricing” for proton therapy. The concept — as established by Justin E. Bekelman, M.D., assistant professor of radiation oncology, and Stephen M. Hahn, M.D., chair of radiation oncology — would set a standard price for different therapies with similar outcomes. This system, they argue, would expand the patient base by providing increased, cheaper coverage; consequently, this would also generate more case-based evidence for proton therapy.9

On the clinical side, Jachinowski said that expanding the use of hypofractionated proton therapy could help even out the total costs. This approach breaks up the total prescribed treatment dose, providing higher-dosage fractions in each session, but this allows for shorter overall length of treatment. “Hypofractionation would make protons cost-neutral,” Jachinowski said.

So though it faces its fair share of roadblocks, proton therapy looks to continue growing as long as it provides a safer, more efficient treatment option for cancer patients.

Related Proton Therapy Content:

Imaging Considerations for Proton Therapy Treatment Planning

Advanced Planning for Accurate Proton Treatments at the Provision Center for Proton Therapy

WEBINAR: Economics of Establishing a Proton Therapy Center

New Approaches to Radiation Therapy

References

1. Sisson, P. “$220M proton center open for business.” www.utsandiego.com, Feb. 19, 2014. Accessed April 8, 2015.

2. “U.S. Proton Therapy Outlook 2017.” www.itnonline.com/article/us-proton-therapy-outlook-2017. Accessed March 31, 2015.

3. Proton Therapy Centers Location Map and Listing. www.proton-therapy.org. Accessed April 8, 2015.

4. Cancer Facts and Figures 2015, American Cancer Society. Accessed April 9, 2015.

5. “Proton Therapy Center and Cyclotron Facilities in Bloomington to Close by Jan. 1, 2015.” www.news.iu.edu, Aug. 22, 2014. Accessed April 9, 2015.

6. “Mevion Medical Gains FDA Clearance for the Mevion S250 Proton Therapy System.” www.itnonline.com, June 11, 2012. Accessed April 3, 2015.

7. “FDA Clears ProTom’s Radiance 330 Proton Therapy System.” www.itnonline.com, March 24, 2014. Accessed April 8, 2015.

8. “FDA Clears Varian’s Proton Therapy System.” www.itnonline.com, Jan. 17, 2014. Accessed April 10, 2015.

9. “Reference Pricing for Proton Therapy Will Help Establish Clinical Benefits.” www.itnonline.com, May 16, 2014. Accessed April 10, 2015.

August 09, 2024

August 09, 2024