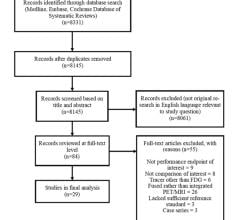

The current state of proton therapy can be assessed fairly quickly by looking at a map: At the end of 2014, there were 51 proton therapy facilities worldwide, with the United States and Japan accounting for more than half (27) and the rest being scattered around the globe. This suggests there are many cancer patients who may not have easy access to proton therapy — a supposition which turns out to be true, according to Paul-Emmanuel Goethals, co-founder of radiation therapy market analysis firm MEDraysintell. According to their numbers, there were roughly 3.2 million patients treated with radiation therapy last year, and only 14,500 of them received proton therapy.

The reason why proton therapy has yet to have a presence in most of the world is no mystery. Like any new technology, initial costs have been high as the equipment is explored and refined — the average price of constructing a proton therapy center has ranged between $150 and $200 million. Many of these facilities were designed with multiple treatment rooms, requiring a larger radiation source with a bigger gantry system to deliver radiation beams to treatment rooms.

Pulling together such large amounts of capital is difficult on its own, and, compounding the problem, there has been relatively little clinical evidence to support proton therapy as a superior cancer treatment method. At the same time, it is difficult to amass clinical evidence when so few patients are being treated — a difficult paradox to overcome.

Despite these challenges, the proton therapy market appears poised to boom, according to Goethals and MEDraysintell. In the 2015 World Proton Therapy report, the company projects the market will achieve a $1 billion value in 2019, with 187 new treatment rooms expected to be built in the next four years. To put it in perspective, Goethals reported that the world market value was $300 million in 2010. “While in the past indications were for a few diagnosed cancers, those cases are increasing,” he said.

View a comparison chart of proton therapy systems at www.itnonline.com/content/proton-therapy-systems. This will require a login, which is free and only takes a minute to complete the form.

Compact Systems

While such a sudden, dramatic increase may seem abrupt, many of the factors that can drive this growth are already in place, according to Goethals. The key to bringing down the cost of proton therapy, he said, is reducing the size of the equipment — an effort that several manufacturers have already begun.

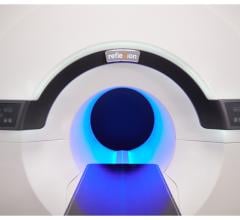

Mevion Medical Systems brought the first compact proton therapy system to market when it received U.S. Food and Drug Administration (FDA) and CE mark approval for the S250 system in 2012. At the center of the compact system is a superconducting synchrocyclotron, which is significantly smaller than the traditional linear accelerator (linac) radiation source. The modular system is designed as a single-room solution, but can be adapted into a multi-room configuration.

Varian entered the compact proton therapy market in 2014 by releasing a smaller version of its original ProBeam system. The ProBeam Compact offers many of the same benefits of its predecessor, including dynamic peak scanning, allowing the application of radiation from different angles simultaneously for intensity-modulated proton therapy, but its 250 MeV cyclotron is more space-efficient than traditional linacs.

Ion Beam Applications S.A. (IBA) introduced the ProteusONE compact proton therapy system in 2014. ProteusONE is also a single-room system offering several different delivery methods, including intensity-modulated proton therapy (IMPT) and image-guided proton therapy (IGPT).

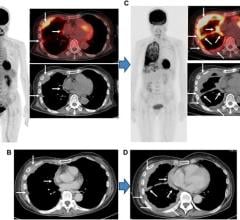

Image Guidance

IBA and Varian are among those that also offer image guidance capabilities. Utilizing IGPT allows radiation oncologists to track the progress of treatment and more precisely target the radiation dose to avoid damage to surrounding tissue and organs. The first image-guided radiotherapy systems have typically used computed tomography (CT) or X-ray, but often encounter issues with image quality and a need to space out sessions to limit extra radiation dose.

Last December, IBA became one of the first to implement cone beam CT for proton therapy, which provides 3-D images of the anatomy for greater accuracy. Incorporated into ProteusONE, the first cone beam CT-guided treatment was completed in December. Varian also utilizes cone beam CT for imaging on ProBeam and ProBeam Compact, with the option to switch to more traditional kV X-ray imaging on ProBeam.

Treatment Planning

Smaller systems and image guidance have helped raise the influence of proton therapy, but its central premise of pinpoint radiation delivery is ultimately what distinguishes it from other forms of radiation therapy. That high degree of accuracy would be difficult to achieve without effective treatment planning, and the continuing development of treatment planning systems and software have only helped proton therapy spread further.

Philips initially introduced its Pinnacle3 treatment planning software for general image-guided radiation therapy, but it released a proton therapy-specific version in August 2013 following FDA approval. The module offers automated contouring and re-planning to quickly adapt treatment on the fly, fast commissioning and even combined proton-photon planning if physicians want to combine proton therapy and conventional radiotherapy. In November 2014, Philips announced a partnership with Mevion that would extend Pinnacle support to the new Hyperscan pencil beam scanning capability (a form of IMPT) of the S250.

RayStation from RaySearch Laboratories has also been a popular choice among proton treatment centers. Pencil beam scanning also is supported here, providing a higher degree of customization to radiation oncologists. “You can actually stop the radiation before it goes too far into a critical structure,” said Marcio Fagundes, M.D., medical director of the Provision Center for Proton Therapy in Knoxville, Tenn., a RayStation user. “It’s really individualizing how you will distribute the dose.”

Related Proton Therapy Content:

Advanced Planning for Accurate Proton Treatments at the Provision Center for Proton Therapy

August 09, 2024

August 09, 2024