Hologic's Selenia Dimensions system

October 3, 2014 — The recent approval of GE Healthcare’s SenoClaire by the U.S. Food and Drug Administration (FDA) will end Hologic’s monopoly of the U.S. digital breast tomosynthesis (DBT) market, offering greater choice for hospitals and patients, according to an analyst with research and consulting firm GlobalData.

Niharika Midha, MSc, GlobalData’s analyst covering medical devices, says that SenoClaire has become only the second DBT system available in the United States and will compete directly with Hologic’s pioneer product, Selenia Dimensions, which has controlled the market since 2011.

According to GlobalData’s estimates, the U.S. is expected to see a significant rise in DBT unit sales, with a compound annual growth rate (CAGR) of 36.4 percent between 2013 and 2020. In addition, DBT is expected to contribute a massive 82 percent toward U.S. breast imaging market revenues by 2020, making this a highly lucrative space for diagnostic imaging players.

“Due to this positive outlook, other companies are also working towards FDA approval for their DBT systems. For example, Siemens Healthcare filed an application for its system, Mammomat Inspiration with DBT option, in June this year,” Midha said.

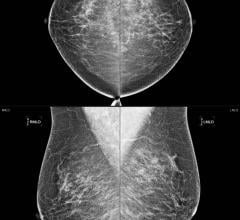

The analyst notes the two approved DBT devices differ significantly in their mechanisms of acquiring 3-D data sets. Selenia Dimensions acquires 15 images over a 15-degree scan angle, and is capable of providing both 3-D mediolateral oblique (MLO) and 3-D craniocaudal (CC) views of the breast, while SenoClaire captures nine images over 25 degrees to form a 3-D MLO view of the breast. It is unclear whether this device also allows acquisition of a 3-D CC view.

In addition, Selenia Dimensions uses a continuous tube motion to capture images, while SenoClaire uses a step-and-shoot motion for the X-ray tube, meaning the gantry comes to a full halt at every X-ray exposure.

Midha continued, “This could mean a higher scan time with SenoClaire than with Selenia Dimensions for the same breast views. It is important to note, however, that a higher scan time does not necessarily mean increased radiation exposure. Irrespective of the differences between the products, GlobalData believes that long-term success will come down to targeted marketing and strategic pricing.”

For more information: www.globaldata.com

July 29, 2024

July 29, 2024