Feb. 27, 2013 -- Fewer breast imaging facilities in the United States, in addition to ongoing controversies surrounding breast cancer screening, has suppressed growth in the U.S. breast imaging systems market. However, Frost & Sullivan anticipates modest expansion, driven by the increasing demand for breast imaging equipment due to the growing prevalence of breast cancer, as well as increases in breast cancer surgery procedure volumes and supplemental screening exams prompted by new breast density reporting legislation.

New analysis from Frost & Sullivan's Analysis of the U.S. Breast Imaging Systems Market research finds that the market earned revenues of $1.0 billion in 2011 and expects this to reach $1.4 billion by 2016 at a compound annual growth rate (CAGR) of 5.8 percent. The anticipated growth is due to growing revenues in the X-ray mammography, breast ultrasound, breast magnetic resonance imaging (MRI) and molecular breast imaging (MBI) market segments.

A key factor restraining market growth is consolidation of the breast imaging provider market, which has led to a smaller number of facilities in the United States. In addition, conflicting recommendations regarding the age at which mammography screening should begin has caused hesitations regarding regular mammography screening exams by many women in their 40s.

"The number of breast imaging facilities in the United States declined by nearly 7 percent from 2002 to 2011, resulting in an even greater decline in the mammography system installed base," said Frost & Sullivan Industry Analyst Roberto Aranibar. "This had a significant impact on market growth, given its large dependency on system replacements."

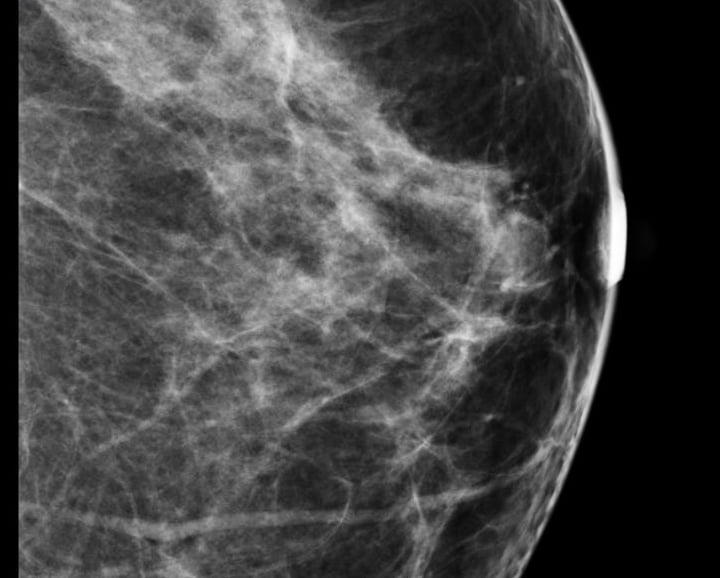

Despite these previous declines in the market, the mammography system installed base and number of breast imaging facilities in the United States appear to have begun stabilizing. New breast density notification laws, product regulatory approvals, and evolving breast cancer screening protocols are among the factors expected to drive increased replacements of mammography systems and expanded adoption of new breast imaging technologies.

"Expanding breast density reporting laws are prompting increases in supplemental screening procedure volumes that, in turn, are creating a growing demand for newer technologies that improve diagnostic accuracy, while also increasing productivity," said Aranibar. "One such technology, automated breast ultrasound (ABUS), was recently approved for supplemental screening, and reimbursement for another such technology, breast tomosynthesis, is expected to become available soon."

July 29, 2024

July 29, 2024