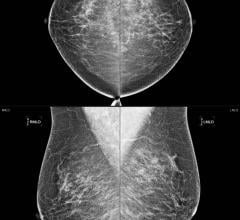

Criticism and confusion notwithstanding regarding the appropriateness of X-ray mammography as the gold standard in breast screening, digital mammography will continue to provide an important cog in the wheel of breast care pathways. The United States, some may say, is a slowing market for the digital mammography imaging modality due to a gradual decrease in the number of breast imaging facilities, reduction in replacement rates of mammography units and the possible linkage of reduced procedure numbers to the 2009 U.S. Preventive Services Task Force (USPSTF) recommendations.

Work Horse in Breast Screening and Diagnostics

X-ray mammography, along with breast ultrasound, continues to account for the majority of breast diagnostics units sold to imaging departments in the United States, amounting to almost 90 percent of all units shipped. Breast magnetic resonance imaging (MRI) and molecular breast imaging (MBI) bring up the rest of the share. Within mammography, digital systems constitute roughly 80 percent of the installed base in the U.S. New mammography units have earned original equipment manufacturers (OEMs) roughly $350 million, and this figure is forecasted to grow at 6 percent over the next few years. Only MBI is growing at double-digit levels given the low penetration of this advanced capability.

Technical Innovation to Drive Uptake Rates

Research and statistics indicate the prevalence rate for breast cancer is increasing in the United States, partly attributable to the aging population. This demographic shift and the associated increase in breast cancer surgery necessitates the increase in presurgical images for intervention planning purposes. Regulatory changes such as the U.S. Food and Drug Administration’s (FDA) classification of full-field digital mammography (FFDM) from Class III to a Class II device category allowed for a faster and less stringent 510(k) submission process, resulting in a dramatic increase in the number of OEMs offering digital mammography in the United States.

The healthy competition and portfolio of solutions offered by the OEMs has been forced to overcome industry challenges. The initial excitement has been somewhat muted from the noise created by conversations around the risks of the over-diagnosis of breast conditions by way of mass screening. This research has highlighted the negative implications of unnecessary breast care interventions in cases that do not warrant any further action. In addition, the 2009 USPSTF recommendations are said to have resulted in a decrease in utilization rates when it comes to breast screening. Though the verdict is still out there, when it comes to the above two restraints in the United States, what has been more telling on FFDM uptake rates is the response to budgetary pressures faced by hospital providers who are slightly reluctant to replace an already large installed base of digital systems. Diagnostic centers are now integrating other modalities into breast screening protocols due to the proven advantages of a multi-modality breast screening approach. Reimbursement cuts due to legislative changes as proposed in the Medicare Physician Fee Schedule (MPFS) and the advances in breast ultrasound in dense breast tissue cases have not helped FFDM either.

Continued technological innovation offered by leading OEMs in digital mammography will help retain the interest levels of breast care professionals who want to stay ahead of the curve in this industry sector. Digital breast tomosynthesis (DBT) is slated to become the next big thing in breast imaging. Hologic remains the only vendor with an FDA-approved system. This company can tout having a head start on the competition by getting an FDA approval for a 2013 upgrade on its Selenia Dimensions 3-D system, further enhancing its leading position in terms of sales units and customer feedback. Other vendors have focused on vital issues such as dosage control, as seen by the MicroDose system offered by Philips that is starting to penetrate the U.S. market. Other OEMs are focusing on software upgrades to break the monopoly in DBT. Software capabilities to measure breast tissue density, image visualization, image distribution and workflow optimization, including the enhancement of sensory perception and patient experience, are the other value additions offered by OEMs both established and new. All said and done, technological advances and the ability of the modality to integrate in a multi-modality system will determine the pecking order of digital mammography systems in breast care.

Siddharth Saha is research director of advanced medical technologies for Frost & Sullivan.

July 29, 2024

July 29, 2024