The Philips Allura Xper and AlluraClarity are among some of the latest generation angiography systems to offer technologies that improve image quality while reducing X-ray dose.

One of the more significant advancements for interventional X-ray (IXR) in the past few years has been an increased focus on core and supporting technologies to provide high-quality, high-resolution images without a corresponding increase in radiation dose.

This has been a key driver behind technology advancements such as Philips’ ClarityIQ technology, Siemens’ Artis Q and Q.zen technology, GE Healthcare’s Image Guided Systems (IGS) and Toshiba’s Infinix Elite product line. GE and Toshiba have moved to a single product line offering, and Philips and Siemens are offering two levels of technology. Philips provides the Allura Xper and AlluraClarity with ClarityIQ technologies. Siemens provides the Artis zee and the Artis Q and Q.zen series.

These solutions integrate new image processing technology and algorithms along with, in some cases, new X-ray tube technology, digital detector technology and other hardware improvements to take advantage of the optimization potential of digital image enhancement.

Monitoring Radiation Dose

New technology has been coupled in many cases with dose awareness as well as dose management solutions that allow the operators to monitor dose exposure to the patient, both in terms of quantity as well as the levels of exposure to the patient’s skin. Dose exposure has always been tracked for the operators via radiation exposure badges, and this is being enhanced with technologies both from the imaging vendors as well as by third-party solutions such as RaySafe.

The challenge to balance dose with image quality has escalated. As imaging technologies continue to move into advanced therapeutic applications with ongoing growth in image-guided applications for surgery and oncology solutions, the need to manage, monitor and control dose exposure while at the same time increasing image quality and resolution has correspondingly grown. These advancements in technology and tools have become even more important to apply, while also understanding and recognizing the critical nature of controlling and limiting dose to the lowest possible levels.

Dose monitoring and educational solutions have become increasingly popular. Philips’ DoseWise, GE’s DoseWatch and Blueprint along with Siemens’ RightDose initiatives are some of these imaging solutions. MD Buyline also has seen a rising interest in third-party solutions such as RaySafe, a real-time dose monitoring solution. All of these solutions are focused on increasing education, awareness and an operator-managed approach to dose management.

The technology advancements combined with programs focused on dose reduction are a large part of the core imaging improvements over the past three to five years.

Market Trends

Based on data from the exclusive MD Buyline database, a clear and steady shift of customers has been seen moving to the advanced image quality and dose management solutions offered by virtually every vendor in this market. Regarding the Philips and Siemens offerings, the Philips AlluraClarity has grown to reflect about 31 percent of quotes seen by MD Buyline.

Siemens’ quotes for the Artis Q and Q.zen solutions represent about 27 percent of the proposals seen. This is in comparison to single or low double-digit figures from the prior years.

Generally, these new solutions carry a higher initial capital cost, but vendors have gotten very competitive, and with special programs and promotions they have made the transition to new technology very attractive. Many vendors offer special incentives to entice customers to “upgrade” from older platforms to more dose-efficient systems with improved image resolution and quality.

There is a debate and vendors have made claims as to who has the lowest dose solution. However, there really is no clear-cut answer. Variability by user, procedure type, procedure length and patient type still have an impact on the results. The newest platforms do deliver on the promise of lower dose with equal or better image quality across a large range of patient body types.

In the general interventional X-ray market, there are a number of vendors. Philips and Siemens are the most commonly considered vendors in this market according to MD Buyline quote activity. There are single plane, biplane and specialty configurations from all vendors that can be considered.

Expanded Applications and Software

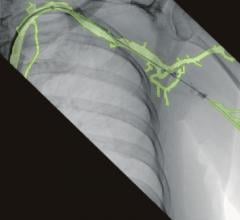

In addition to the advancements seen from the vendors, there is also an increasing movement toward specialized software solutions that can expand and enhance specific advanced imaging applications for interventional X-ray solutions.

Oncology

MD Buyline has begun to see an interest in oncology applications that assist in image-guided deployment of radiation treatment solutions. We have seen a significant number of proposals that incorporate software designed to assist in oncology-related therapy from most vendors. This is a more recent trend with a quickly increasing interest representing about 7 percent of the activity we have seen. This is up from little to no activity in the previous years.

Neurology

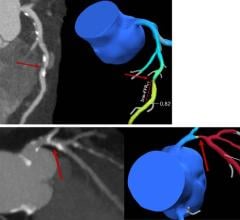

All vendors have continued to improve and expand their 3-D imaging as well as rotational angiography to produce CT-like imaging capabilities. This 3-D capability assists physicians in more advanced diagnostics and therapeutic techniques for stroke diagnosis, evaluation and treatment. Neurology solutions have remained fairly steady, representing about 7 percent of the deals we have seen over the past 12 months.

Combining IXR and Ultrasound

There has been an increasing number of proposals that are combining angiography systems with traditional ultrasound units. The applications are primarily focused on image-guided procedures and structural heart. The systems are beginning to incorporate technology that allows images from multiple sources to be displayed on a single large monitor.

Interventional X-ray and CT

More interest is being seen in more advanced imaging system combinations, primarily systems that combine interventional X-ray with CT. The most active vendors in this arena are Siemens and Toshiba. The focus is on the growing area of minimally invasive interventional procedures, where imaging and data from both CT and IXR can be useful. The challenge is two-fold: The cost of a combined solution is significant, and you are committing the two systems to a combined solution. While they can be used independently, use of one system precludes the use of the other for a different patient. It is imperative to have the procedure mix that will provide a sufficient patient volume to justify a combined solution. It is a much larger footprint than either solution alone, so it requires an expanded floor plan for installation. Over the past two years there have been less than five proposals for this solution. It is still a very university/research type of application and it will likely be a long time before this type of solution makes its way to the mainstream clinical setting.

While surgery is still the gold standard and has a long history of clear clinical outcomes, it comes with a much higher price in terms of length of hospitalization, recovery time and related costs. The catheter-based approach provides a clear reduction in these areas.

Oncology treatments seem to be an emerging area too. The vendors and technology have shown they can adapt to focusing on solving clinical needs, which, I believe, will continue to be a cornerstone of research and development going forward.

Tom Watson, RCVT, is a clinical analyst for MD Buyline.

May 17, 2024

May 17, 2024