In the past year, the radiology community has been a first-hand, hands-on witness to myriad unexpected challenges and unprecedented partnerships emerging on the scene of the contrast media market — from collaborating on conservation strategies, innovating for new product development, to forging partnerships and establishing new distribution outlets.

The companies in the business of making contrast agents have had a year like few others. The surprisingly small number of major players in the market — Bayer AG, Bracco Diagnostics, GE HealthCare, Guerbet, and others — bely the impact and reliance of heathcare providers on such a distinctive and in high demand diagnostic tool. The market analyses produced by multiple forecasters who carefully monitor growth and trends within the diagnostic radiology industry all point in one direction: upward, and swiftly so.

Consider this: the contrast media market value in 2021 was reported at $5.4 billion, according to Verified Market Research (VMR) in its January, 2023 report, “Contrast Media Market Size and Forecast.” This and other recent forecasts, who assess multiple areas of impact and segmentation analysis, are projecting the market to reach $6.8 billion by 2030, growing with a 2.59% CAGR from 2023-2030. In its latest forecast, “Contrast Media/Contrast Agent Market Size, Share, Growth Report 2030,” released in February 2023, Zion Market Research projected the market will reach $5.6 billion, and forecasts a slightly higher CAGR at 3.5% — each taking in multiple factors, but each reflecting markedly positive growth.

Overview of Analyst Insights

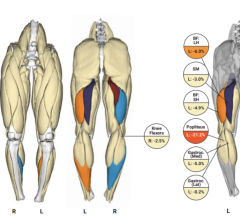

Market watchers and imagers alike report an aging population and more chronic diseases are driving the need for more interventional diagnostics. Radiology, interventional radiology and interventional cardiology, in that order, all rely on contrast media to identify health disorders and guide treatment for their patients. Cardiology, oncology, gastrointestinal disorders, cancer and neurological disorders increasingly rely on contrast media. Growth in these areas continues to be a dominant driving factor in what has been seen as a strong, steady increase in investment into research and development for stronger imaging, and better patient diagnoses, treatment and health.

Zion Market Research noted contrast media producers have made significant R&D investments as a result of the rising demand for imaging procedures to launch new products and acquire approval for novel indications. Analysts report that growing technological advancements in prenatal genetic screening would further enhance the contrast media/contrast agent industry.

Segmentation analysis focuses on type, procedure, indication and geography. The different types of contrast media include iodinated, gandolium-based, barium-based and microbubble; in early 2023, GE HealthCare announced completion of a Phase 1 study of first-of-its-kind macrocyclic manganese-based MRI contrast agent.

Based on modality, the market is segmented into X-ray/computed tomography (CT), ultrasound, magnetic resonance imaging (MRI) and fluoroscopy. The X-ray computed tomography (CT) segment dominates the market with the highest market share, noted Verified Market Research, attributing that growth to its cost-efficiency, which results in the high use of contrast media in this segment.

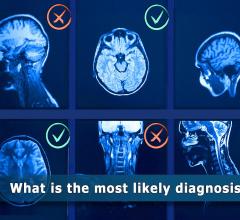

In a geographic market breakdown assessing North America, Europe, Asia Pacific and the rest of the world, VMR also reported: North America has the largest market share, and is expected to continue to; the United States the largest contrast media user; within the U.S., ultrasound is the most predominant modality. Additionally, in its February 2023 report, Zion Market Research noted that over the 2020-2030 forecast period, based on product type, the iodinated segment is projected to hold the largest market share, and based on application, the neurological disorders segment will dominate the market.

Growth Factors

With such a wide range of diagnostic applicability, and the growing population of people with chronic disease, market leaders, industry analysts, as well as radiologists and patients, are keenly aware of the value and visibility contrast media bring to overall global health. The increasing volume of scientific sessions, educational symposia, clinical trials and corporate collaboration has reached unprecedented levels in order to bring innovation and diagnostic excellence into each and every healthcare setting worldwide. The challenges which emerged from the COVID-19 supply issues, and from an ever-growing patient base requiring radiologic imaging, is certain to continually boost the rate of innovation and the research required to bring these solutions to the fore.

In its market outlook, Verified Market Research offered valuable insight into what’s ahead, writing: In upcoming years, the patents issued by the companies are going to expire, which will open the gates for generic pharmaceutical producers which will drop the price of this technology. Notably, as more people would access the advantages provided by this technology, this might come as an opportunity for the global market. A large amount of investments being made into research and developments programs for contrast media — to improve quality and remove related side-effects, were identified as additional factors driving the market.

View the MRI Contrast Agents Comparison Chart here

Find more Contrast Media content here

Related Content of MRI Gadolinium Safety Concerns

The Debate Over Gadolinium MRI Contrast Toxicity

VIDEO: How Serious is MRI Gadolinium Retention in the Brain and Body? An interview with Max Wintermark, M.D.

VIDEO “Big Concerns Remain for MRI Gadolinium Contrast Safety at RSNA 2017,” An interview with Emanuel Kanal, M.D.

Radiology Has Failed to Properly Assess or Track MRI Gadolinium Contrast Safety

Recent Developments in Contrast Media

FDA Committee Votes to Expand Warning Labels on Gadolinium-Based Contrast Agents

European Medicines Agency Issues Update on Gadolinium Contrast Agents

ISMRM Issues Guidelines for MRI Gadolinium Contrast Agents

FDA: No Harm in MRI Gadolinium Retention in the Brain

March 19, 2025

March 19, 2025