December 29, 2021 — The global nuclear imaging devices and equipment market is expected to grow from $2.45 billion in 2020 to $2.79 billion in 2021 at a compound annual growth rate (CAGR) of 13.9%. The growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges. The market is expected to reach $3.22 billion in 2025 at a CAGR of 3.6%.

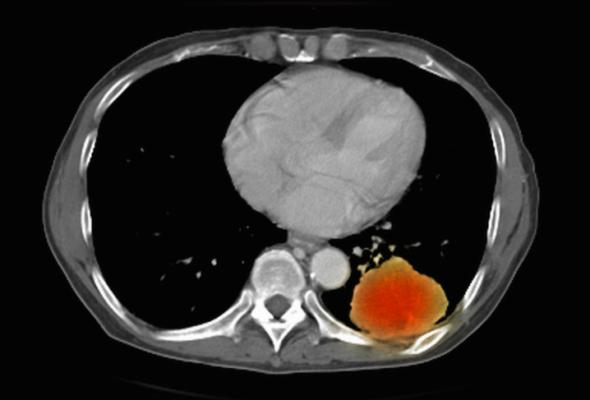

The nuclear imaging devices and equipment market consists of sales of nuclear imaging devices and related services. Nuclear imaging devices and equipment are used in the diagnosis of radioactive substances in the patients. The key product types of the market include SPECT (single-photon emission computed tomography) systems (hybrid SPECT and standalone SPECT) and hybrid PET systems. These products are used in a wide range of medical applications including cardiology, obstetrics/gynecology, vascular, urology, and other medical applications.

The Nuclear Regulatory Commission (NRC), USA regulates the manufacture and use of radioactive materials in nuclear imaging devices, as well as radiation therapy and research. It has agreements with 37 US states which allows them to regulate the use of certain radioactive materials by giving licenses to hospitals, clinics and medical centers. The US based Food and Drug Administration (FDA) also regulates products and procedures that are radiation-emitting. It reviews the safety and use of radiopharmaceuticals and machines like x-rays, which produce radiation but do not make or use radioactive material.

Companies in the nuclear imaging devices and equipment market are using hybrid imaging technologies such as positron emission tomography/computed tomography (PET/CT), single-photon emission computed tomography/computed tomography (SPECT/CT), and positron emission tomography/magnetic resonance imaging (PET/MRI) for nuclear medical imaging. These hybrid systems provide precise images with better resolution, and both morphological and physiological information in just one instance of testing. For instance, a SPECT/CT system for skeletal evaluation offers accurate localization and improves the specificity of information provided by CT.

The nuclear imaging devices and equipment market is bPEReing driven by increasing incidences and prevalence of diseases such as cancer, heart disease, gastrointestinal, endocrine and neurological disorders. Such diseases are diagnosed in relatively early stages by nuclear imaging equipment as compared to other equipment. For instance, according to the American Cancer Society 2020, in the United States, 1.8 million new cancer cases are diagnosed and 606,520 cancer deaths in the United States, many of which have been diagnosed by nuclear imaging devices and equipment.

In January 2018, Canon acquired Toshiba Medical Systems for $6.21 billion. The acquisition is expected to strengthen Canon's focus on developing its medical equipment business. Toshiba Medical Systems is a medical equipment company specialized in diagnostic imaging equipment, founded in 1948 and is headquartered in Tochigi, Japan.

The nuclear imaging devices and equipment market is being restrained by strict regulations by the Nuclear Regulatory Commission (NRC) medical use. For instance, the NRC requires nuclear imaging equipment licensees to use and store radioactive materials to protect workers and common people by removing unwanted exposure, which has resulted in a relatively less number of nuclear imaging equipment being manufactured.

For more information: www.researchandmarkets.com/r/6l91gn

November 18, 2025

November 18, 2025