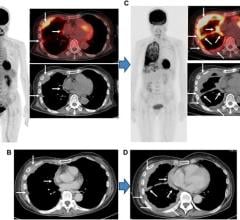

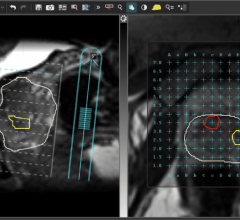

An example of HeartFlow's FFR-CT analysis of blockage severity in a patient's coronary vessels based on a cardiac CT scan.

July 15, 2021 — HeartFlow, which has commercialized noninvasive computed tomography derived fractional flow reserve (FFR-CT) assessment technology, announced it is merging with Longview Acquisition Corp. II, to become a publicly traded company. Upon completion of the proposed transaction, the combined company will operate as HeartFlow Group Inc. and is expected to be listed on the New York Stock Exchange under the symbol HFLO.

The transaction will also provide the combined company with an estimated $400 million in cash for growth capital, product development and general corporate purposes to expand the FFR-CT technology.

Longview is a special purpose acquisition company sponsored by affiliates of Glenview Capital Management LLC. The proposed transaction has been unanimously approved by each of Longview’s and HeartFlow’s Board of Directors. The proposed transaction is subject to the approval of Longview’s stockholders and the satisfaction or waiver of other customary conditions, including a registration statement being declared effective by the U.S. Securities and Exchange Commission (SEC), and is expected to close in the fourth quarter of 2021.

“We believe that our noninvasive, artificial intelligence-enabled, cloud-based enterprise software solution can transform cardiovascular care with risk assessment, diagnosis planning and treatment management,” said John H. Stevens, M.D., president, CEO and co-founder of HeartFlow. “Importantly, we have brought together a talented group of individuals with deep expertise in technology, cardiovascular medicine and the business of healthcare and a deep commitment to patients to deliver on this vision. I’m incredibly proud of the HeartFlow team in reaching this important milestone.”

“We are thrilled to co-invest with the associates, leadership and shareholders of HeartFlow to promote rapid adoption of their life-saving, revolutionary approach to cardiac evaluation,” said Larry Robbins, chairman of Longview and CEO of Glenview. “For us, HeartFlow’s compelling investment attributes leapt off the page: addressing a massive unmet medical need with proprietary, innovative technology through a highly attractive business model that experts widely cite as delivering superior patient outcomes at lower systemic costs.”

FFR-CT May Revolutionize Cardiac Care

HeartFlow’s artificial intelligence (AI)-enabled software platform brings precision heart care to cardiology. The HeartFlow Analysis is the only non-invasive tool to assist with the diagnosis, management and treatment of patients with heart disease. It used data from cardiac CT scans feed into super-computing applications to create a 3-D model of the coronary tree and shows color-coded FFR blood flow assessments for the vessels. FFR is usually performed in a cath lab using a wire that is inserted into the patient and guided to the vessel segment where there is a clinical question on the severity of blocked vessels. This technology allows for a more comprehensive noninvasive exam to determine if a patient requires percutaneous coronary intervention (PCI) to stent blockages, or if they cab just be treated with medications.

Hearflow's FFR-CT technology holds the promise of reducing or eliminating the need diagnostic catheterizations and invasive angiograms and allowing procedure pre-planning and guidance images if an intervention is required.

HeartFlow has demonstrated higher diagnostic accuracy compared to other noninvasive tests with an 83% reduction in unnecessary invasive angiograms,[1,2] resulting in a significant reduction in the total cost of care.[3]

HeartFlow Company Overview

Founded 11 years ago, HeartFlow is revolutionizing precision heart care with noninvasive, personalized cardiac tests and associated enterprise software suite solutions to address heart disease, the leading cause of death in the world. HeartFlow’s core product, the HeartFlow FFR-CT Analysis, is a noninvasive cardiac test for stable symptomatic patients with coronary artery disease (CAD), the most common type of cardiovascular disease. With the HeartFlow FFRCT Analysis, the company currently targets a $10 billion total addressable market opportunity that it plans to expand to over $50 billion through the introduction of new products, new customer site additions and increased utilization of HeartFlow in existing healthcare systems over the coming years.

HeartFlow’s technology and business model democratize access to best-in-class diagnostic precision and therapy optimization for all patients. CAD diagnosis and management are rife with disparities in access and care across socially vulnerable populations, who often receive less care, and less than optimal care. The HeartFlow Analysis provides objective quantitative results, minimizes the need for patient visits, and enables access in diverse settings of care from primary care clinics to physician offices to hospitals. As such, HeartFlow delivers the same high-quality solution to all patients regardless of gender, race, ethnicity, geographic location and socioeconomic status.

The HeartFlow Analysis is based on more than 25 years of scientific research and clinical data on the patient-specific modeling of blood flow in arteries. The company has performed the HeartFlow Analysis on more than 100,000 patients through clinical development and commercialization.

The HeartFlow Analysis has regulatory clearance and is commercially available today in the U.S., the EU, the U.K. and Japan. The company's commercial footprint includes over 470 customer sites globally, with 300 of those in the U.S., including 80% of the top 50 heart hospitals in the U.S., as listed by U.S. News and World Report. There are currently more than 425 publications specific to the HeartFlow Analysis in peer-reviewed medical journals studying over 10,000 patients with up to five years of follow up data.

HeartFlow is led by an experienced management team with significant cardiology, medical technology, and software expertise. The current Board of Directors is comprised of a combination of highly regarded investors and experienced operating executives including Chairman William Weldon, former Chairman and CEO of Johnson and Johnson, and Lonnie Smith, former Chairman and CEO of Intuitive Surgical. John Rodin, CEO of Longview, will join HeartFlow’s Board of Directors upon completion of the merger.

The proposed transaction values HeartFlow at an initial pro forma enterprise value of approximately $2.4 billion and a fully distributed equity value of approximately $2.8 billion at signing. The transaction is expected to deliver up to $599 million of gross proceeds to HeartFlow (all coming from the $690 million cash in trust held by Longview) to accelerate growth as well as repurchase up to $110 million of equity from long-time shareholders and employees, representing approximately 5% pro forma shares outstanding. Any excess cash in trust will be distributed by Longview to its shareholders through a special dividend of up to $91 million immediately prior to closing. Pro forma for the business combination, legacy shareholders of HeartFlow and its employees will own approximately 73% of the public company.

Related FFR-CT Content:

VIDEO: Use of FFR-CT to Non-invasively Evaluate Coronary Lesion Severity — Interview with James Udelson, M.D.

Novel FFR Methods Can Reduce Procedure Time and Cost

NICE Renews Support for Use of AI-powered HeartFlow Analysis

FFR-CT Did Not Significantly Reduce Costs But Reduced Rates of Invasive Coronary Angiography

Current Evidence for Cardiac CT Calls for Change in Recommendations and Reimbursements

New Technologies Take Cardiac CT to the Next Level

Image-based FFR May Replace Pressure Wires and Adenosine

New Technology Directions in Fractional Flow Reserve (FFR)

8 Cardiovascular Technologies to Watch in 2020

VIDEO: Using FFR-CT in Everyday Practice

FFR-CT is Ready for Prime-time Evaluation of Coronary Disease

6 Hot Topics in Interventional Cardiology at TCT 2019

FFR-CT: Is It Radiology or Cardiology?

References:

August 09, 2024

August 09, 2024