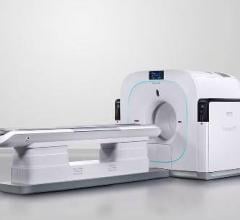

The Philips Ingenuity TF PET/CT system leverages multiple technologies.

The continuum of personalized care, covering individualized prevention and therapy, translates into multiple changes to patient data sources. One of the primary sources is medical imaging that evolves into various multimodalities, allowing simultaneous acquisition of clinical images. Positron emission tomography/computed tomography (PET/CT) systems have been around for more than a decade, and now PET/magnetic resonance imaging (MRI) scanners are working to reach the market.

However, while PET/CT scanners were adopted quite naturally and at a fast pace, PET/MRI systems are not being welcomed as warmly. According to an article in the Journal of Nuclear Medicine’s (JNM) August 2016 issue, “since its first commercial installation in 2011, the number of facilities housing PET/MRI systems has increased to 70 worldwide.” Maybe it is just that five years are nothing for healthcare, or it could be that the reason is rooted somewhere deeper.

The Application of PET/MRI Scanners

PET/MRI systems align the features of MR imaging — such as soft tissue contrast, diffusion-weighted imaging and dynamic contrast-enhanced imaging — with the PET-provided quantitative physiologic and metabolic data.

Many PET/MRI scanners are used for research purposes. For example, Stanford University is using GE Healthcare’s system for research only, with efforts put into identifying diseases and patients who are ideal candidates for PET/MRI.

In JNM’s August 2016 article, the picture is quite different. The authors surveyed the facilities housing PET/MRI systems to find out the areas of application. Only a few centers used double-modality scanners for either clinical (13 percent) or research purposes (19 percent). Others adopted the mix-and-match approach, combining clinical and research purposes.

Speaking of modalities, the following fields can harness PET/MRI images.

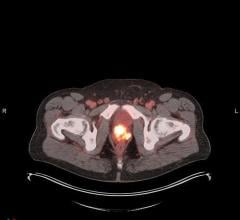

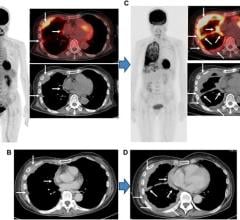

Oncology. Currently, oncology is an application that can gain major value from double-modality synergetic images. As precise locating of tumors and defining of the damaged areas around it frequently takes a few clinical images across modalities, it is easier to enable medical image analysis with simultaneously acquired and automatically registered double-modality images.

Even if the registration stage isn’t automatic, the challenging tasks assigned to image analysis algorithms can be facilitated through simultaneous image acquisition and almost changeless patient positioning.

By processing synergetic images, the image analysis software can streamline early cancer detection and accurate staging. It can also assist in treatment planning and therapy selection. Upon a patient’s therapy progression, PET/MRI images provide enough data to efficiently monitor treatment response.

Of the 39 surveyed healthcare organizations that named oncology as their primary application of PET/MRI scanners, 88 percent were at clinical facilities and 76 percent at research centers.

Neurology. PET/MRI images also help in delivering advanced care to patients with various neurologic pathologies. Analysis of both anatomical structures and metabolic processes allows clinicians to detect and evaluate neurodegenerative diseases and psychological disorders more efficiently. Moreover, synergetic images are also useful for biopsy guidance, treatment planning and response assessment.

Healthcare organizations were found to use PET/MRI devices for neurology as a secondary application after oncology, with 9 percent at clinical and 12 percent at research facilities.

Cardiology. In cardiology, PET/MRI scanners enable tissue characterization, morphology and ventricular function visualization. The complex algorithms of image analysis software can detect even subtle changes in tissue composition. Particularly, synergetic images can be promising for diagnosing and treating sarcoidosis, myocarditis and myocardial infarction.

Seven out of 39 survey participants used PET/MRI scanners to diagnose atherosclerosis, cardiac fibrosis and vasculitis.

Five Years of Manufacturing PET/MRI Systems

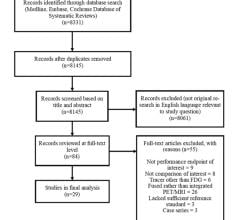

Three multinational corporations presented their vision of PET/MRI scanners in 2011. As years passed, a few of these companies changed their market strategy. I’ve compared 2011 and 2016 company-wise and according to their offers to track how just five years can transform a manufacturers’ approach to PET/MRI imaging.

Siemens, 2011. Introduced in 2011, the Biograph mMR system allowed completely simultaneous PET/MRI imaging of both anatomy and function. Siemens’ representatives also pointed out that they created a single device to contain both PET and MRI imaging capabilities, because two separate devices and two separate images with post-merging couldn’t bring any time savings or benefit. Such examination in two separate scanners took about 60 to 90 minutes, while the Biograph mMR could provide a PET/MRI image in approximately 30 minutes.

2016. Biograph mMR is still on the market. While Siemens has continued to improve the technology, the device itself stays true to the 2011 synergy of PET and MRI modalities within one package.

Philips, 2011. Philips Healthcare created the Ingenuity TF PET/MR system that uses separate PET and MRI scanners located in the same room. Back then, the innovation was in using an automated table gantry. First, the system scanned a patient on the MRI and then rotated 180 degrees to proceed with the PET scanning.

The table gantry allowed the clinician to keep a patient’s position during scanning and eliminated the need to manually move the patient from one table and device to another. However, such systems required more space than a single MRI or PET scanning room. It required between one-and-a-half to two rooms.

2016. The Ingenuity TF PET/MR system from 2011 has been replaced with the Philips Ingenuity PET/CT system, which helped fill the increased demand for combined PET and CT modality scanners compared to PET/MRI devices.

GE Healthcare, 2011. In 2011, GE decided to create a mobile patient table to enable the “triple kill” solution. The idea was in using the table to transfer the patient between GE’s PET/CT and MRI devices for registered trimodality imaging. The value of such a solution was in keeping the patient in the same position to facilitate following registration of acquired images.

The mobile patient table was also a cost-effective and cautious solution that didn’t require major investments before a healthcare organization would actually feel the need for a one-device PET/MRI system.

2016. After 2014, GE changed its “table game” and also developed the SIGNA PET/MR device. It allows for simultaneous acquisition of PET and MR images, the same as Siemens’ Biograph mMR. Hence, we can conclude that GE took their time to examine the clinical value of a standalone system and decided that it is what healthcare organizations would benefit from.

Benefits in PET/MRI Adoption

We touched on a few significant benefits of PET/MRI scanners above:

• Saving time. Compared to separate PET and MRI examinations, the simultaneous procedure takes about 30 minutes instead of 60-90.

• Imaging the most complex cases. PET/MRI can be used for advanced diagnostics in oncology, neurology and cardiology.

• Saving space. The 2-in-1 system helps to optimize room utilization within the healthcare organization, while providers definitely need two separate rooms for PET and MRI devices.

• Improving registration. Due to the same patient position throughout the examination in simultaneous PET/MRI scanning, a health specialist will have a synergetic image with a better quality compared to separate PET and MRI.

One of the most convincing advantages of PET/MR imaging over PET/CT alternative is the lack of ionizing radiation, allowing a reduction of the overall radiation dose that patients can get during the examination. It is especially important for oncologic and pediatric imaging.

Challenges in PET/MRI Adoption

On to the bitter side of PET/MRI imaging:

Attenuation correction (AC) issues. The PET/CT devices use X-ray-based correction, which is impossible in PET/MRI. MRI depends on bone for AC calculations, which makes it difficult when it comes to calculating attenuation coefficients.

Workflow clogs. Acquisition times for PET/MRI vary depending on MR pulse sequences. While simultaneous imaging is better in comparison with PET and MRI separately, it may fall short to PET/CT imaging, which could impact workflow.

Cooperation odds. The care team collaboration is a valuable part of care delivery. However, it still may be challenging to establish seamless cooperation between the radiologists and nuclear medicine physicians, which is essential for interpreting hybrid PET/MRI images.

Investment risks. The cost of a PET/MRI scanner is approximately within the range of $4-5 million. By adding another 10 percent to the expenditures for annual maintenance and salaries for technologists, healthcare organizations may find themselves struggling to predict ROI.

PET/MRI Systems in the Future

Opinions on how PET/MRI imaging will evolve vary depending on all parties involved. Patient-wise, there’s one major value of a reduced radiation impact (compared with PET/CT), especially for children. However, the CT imaging is also evolving with dramatic reductions in radiation dose. While not close to MRI with its zero radiation, this can be easy enough to maintain using the PET/CT.

Such challenges as additional investments and workflow issues may keep PET/MRI reserved mainly for research purposes, as a clinic housing the PET/CT scanner will most likely continue its use.

However, PET/CT also struggled with its adoption at first, which could also be the case with PET/MRI devices. New technology could give it an advantage over PET/CT systems in the future, as well. With the industry evolving so rapidly, anything could happen.

Related PET-MRI Content:

PET/MRI: The Modality of Choice?

PET/MRI Enters the U.S. Market

Jury Still Out on Effectiveness of PET/MRI Versus PET/CT

Lola Koktysh is a healthcare industry analyst at ScienceSoft, a software development and consulting company headquartered in McKinney, Texas. Being a HIMSS member, she focuses on healthcare IT, highlighting the industry challenges and technology solutions that tackle them.

July 31, 2024

July 31, 2024