August 3, 2016 — Digital breast tomosynthesis (DBT) or 3-D mammography new installations (includes new equipment and 3-D up-gradation) expected to reach 4,547 units in 2016, up from 4,061 units in 2015. In terms of revenues, the global digital breast tomosynthesis equipment market is expected to reach 1,007.6 million in 2016, witnessing a year-over-year growth of 13.7 percent.

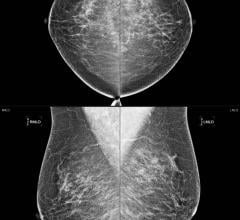

Limitations concerning the flat nature of images achieved through a 2-D full-field digital mammography (FFDM) is influencing end-users to adopt DBT equipment for diagnosis of breast cancers. Digital breast tomosynthesis enables radiologists to analyze abnormalities lucidly, helping improve detection rates while reducing callbacks. In the backdrop of these factors, demand for digital breast tomosynthesis equipment is witnessing an uptick, and the trend is expected to gain further momentum in the future.

Sales of DBTs have remained quite robust in the US in the recent past, making North America the most lucrative market globally. The market in the region is largely dominated by Hologic, Inc., although GE and Siemens Healthineers have also registered their presence by launching innovative DBT products at competitive prices. Total DBT equipment revenues in North America were pegged at 472.8 million in 2015, with the U.S. accounting for bulk of revenue share. New equipment installation base in North America is expected to reach 2,327 in 2016, up from 2,066 in 2015.

In addition to North America, digital breast tomosynthesis sales are also growing steadily in Western Europe and APEJ. Revenues in Western Europe are anticipated to grow by 13.4 percent in 2016, whereas APEJ is expected to increase at 12.2 percent.

By end-users, hospitals account for higher demand for DBTs vis-à-vis diagnostic centers. Many hospitals are in the process of upgrading their existing mammography machines, owing to which demand for DBT equipment is growing at a steady rate. However, high costs, coupled with lack of awareness can impede adoption rates in both hospitals and diagnostic centers, and slow down the growth of the market globally. Installations of DBTs in hospitals totaled 3,020 in 2015, representing a market value worth 542.8 million.

Key players in the global digital breast tomosynthesis equipment market include Hologic Inc., GE Healthcare, Siemens Healthineers, Internazionale Medico Scientifica, Fujifilm, and Planmed Oy. The top three players — Hologic, Inc., GE Healthcare, and Siemens Healthineers — collectively account for nearly 90 percent revenue share of the market.

For more information: www.futuremarketinsights.com/press-release/digital-breast-tomosynthesis…

March 21, 2025

March 21, 2025