August 18, 2011 - A new KLAS report, "Positron Emission Tomography (PET)/Computed Tomography (CT) 2011-New Technologies in Focus," measures the innovative pairing of nuclear medicine scan technologies and reviews of the top three vendors in the market space: GE Healthcare, Philips and Siemens.

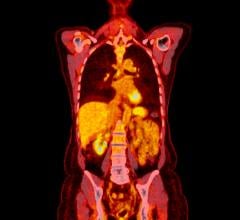

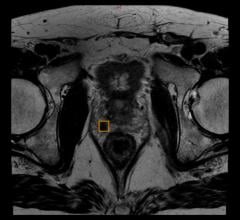

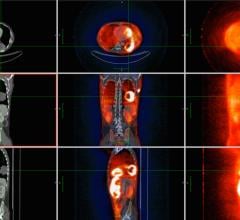

Providers, including imaging centers and hospitals, have started replacing their separate PET and CT devices with PET/CTs. Although the higher cost of the new equipment is somewhat offset by the benefits of having two devices in one, a reduction in scan time and a significant improvement in resulting image resolution, imaging technologists are more satisfied with the improvement in the technology than administrators are with the cost or return on investment thus far.

"When it comes to provider satisfaction, every PET/CT vendor measured in the report scored high. In fact, they scored well above the KLAS medical equipment average for service and even the score for the lowest ranked system was high," said Ben Brown, general manager of imaging research. "However, PET/CT technology is still a new enough technology that providers are struggling with how to maximize the use and reimbursement payments for these devices."

GE Healthcare scored ahead of Siemens and Philips with an overall score of 87.7 out of 100, but took first by only a slim margin. All three vendors offer similar baseline technology, with few overt differentiators. While the GE Healthcare Discovery PET/CT excels in implementation, medical imaging service and support, it lost points for account management -- specifically too much 'nickel-and-diming' during the process -- and providers said that the technologist interface was not very easy to use. However, all of the Discovery clients interviewed said that they would select it again and that they would recommend it to a colleague.

The Siemens Biograph is also well-liked, and users were very positive about implementation, account management and image quality. Philips' Gemini clients were more than happy with the contracting experience, the functionality and the larger bore size, as well as reporting excellent image quality. They felt, however, that the physical ergonomics of the device were lacking inasmuch as patient comfort was concerned.

"As this was the first year KLAS has researched PET/CT devices," added Brown, "we do not yet have year-over-year comparison data available. It is clear that, although many providers were not using their PET/CT devices at full capacity, all were very happy with their new nuclear medicine imaging equipment. For vendors to stand out in this market, they will have to provide ongoing, exceptional service to providers."

One huge obstacle to the greater use of PET/CT is the cost and difficulty to produce and deliver the radiopharmaceuticals required for PET imaging, which are also usually extremely short-lived; as this industry grows, vendors that consistently provide on-time, proactive service to their clients will continue to be the big winners.

For more information about the PET/CT market, as well as the strengths and weaknesses of measured vendors, "PET/CT 2011-New Technologies in Focus" is available to healthcare providers online for a significant discount off the standard retail price.

For more information: www.KLASresearch.com/reports

July 02, 2024

July 02, 2024