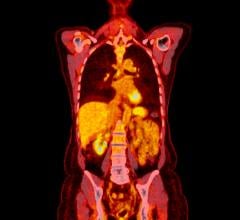

Despite its first commercial appearance in the late 1970s, positron emission tomograpnhy (PET) did not begin gaining widespread acceptance as a viable clinical technology until the mid-1990s. This was after it gained approval for reimbursement and radiopharmaceuticals for PET became more widely available. The release of integrated PET/computed tomography (CT) systems in 2001 and significant expansions in the distribution networks of major radiopharmaceutical producers, such as PETNET Solutions and Cardinal Health, also played a major role in driving further adoption and securing its status as a standard in oncology.

The U.S. PET systems market was valued at $324 million in 2010, making it a pivotal year, as annual revenues made a sharp upward turn after experiencing declines for several years. The market remained highly concentrated in 2010, with its three leading revenue contributors — GE, Philips and Siemens — generating more than 90 percent of annual revenues through sales of 10 different integrated PET/CT systems. The remainder of the market’s revenues is generated by Naviscan and Positron, competitors that offer PET-only systems designed primarily for organ-specific imaging.

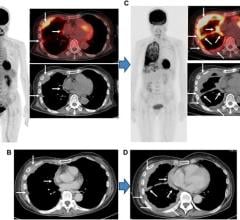

Approximately 90 percent of PET procedures involve applications for cancer diagnosis and monitoring, but the impending commercial release of a number of novel radiotracers that aid in the diagnosis of prevalent neurodegenerative conditions, such as Alzheimer’s disease, have encouraged further adoption of PET in neurology – a long-standing, but historically smaller segment of the market. The development of F18-florbetapir by Avid Radiopharmaceuticals (now a subsidiary of Eli Lilly), for example, enables the detection of amyloid deposits in the brain, a key precursor to Alzheimer’s disease, which was previously identified only in post-mortem brain samples. Similarly, GE developed F18-flutemetamol to aid in the diagnosis of Alzheimer’s. It’s expected to improve upon the limitations of its short-lived parent molecule, C11-Pittsburgh compound B (C11-PiB).

PET is increasingly utilized in cardiology for myocardial perfusion imaging (MPI), a trend many attribute to a shift in user preference from single photon emission computed tomography (SPECT) to PET MPI due to clinical advantages and uncertainties in supplies of SPECT radioisotopes. This trend is mirrored by Bracco Diagnostics’ reports of increases in the production of rubidium-82 over the last few years, as well as strong sales of Positron’s Attrius, a cardiac-optimized PET-only imaging system. General-purpose PET-only systems have virtually disappeared over the last few years, but stand-alone, organ-specific systems have gained market traction.

One such system, manufactured by Naviscan, is designed primarily for use in molecular breast imaging (MBI) applications through the implementation of a technique known as positron emission mammography (PEM). A number of recent studies demonstrated PEM’s superior accuracy in detecting breast cancers relative to breast magnetic resonance imaging (MRI). This, together with the cost and clinical benefits of this technology, has led to growing adoption.

Demand for PET in radiation oncology also is growing, and manufacturers are responding by introducing larger bore PET/CT scanners that are tailored to the specific needs of radiation therapy users. Philips, for example, introduced a “Big Bore” version of its Gemini TF PET/CT that features an 85cm-diameter bore, which can accommodate radiotherapy positioning devices. With the growth of PET in radiation therapy and the high degree of precision required in this area, vendors have begun introducing improved software to help users maintain their normal department workflow while using respiratory- or cardiac-gating techniques.

Solutions facilitating the use of gating include GE Healthcare’s Renew upgrade and Dynamic Vue imaging software for its Discovery PET/CT console. Philips also streamlined visualization and analysis of gated PET/CT data through the provision of its fusion viewer application on its Gemini TF, and Siemens improved viewing and processing of gated image datasets through its syngo Oncology Engine with TrueD, offered in its Biograph mCT and TruePoint PET/CT scanners.

Hybrid PET manufacturers have begun introducing solutions to streamline the acquisition and registration of whole-body PET/MRI data. In the latter half of 2010, GE introduced its PET/CT + MR solution, a two-room solution that consists of a fusion software package and a transportable patient table with a tabletop that adapts to separate PET/CT and MRI scanners.

Bringing the integration of PET and MRI one step closer, Philips introduced the Ingenuity TF PET/MR system, which is comprised of separate PET and MRI gantries installed in a single room. They are joined by a motorized table that rotates and moves patients from one gantry to the next.

Siemens introduced a fully integrated (i.e., single-gantry) PET/MRI system, the Biograph mMR, which enables simultaneous acquisition of whole-body PET and MRI data. This system gained FDA 510(k) clearance in June.

Competitors are focusing on removing the long-standing cost barrier associated with PET/CT through the development of more cost-efficient systems. Purchase and investment value have become top priorities for buyers who, recognizing the ongoing uncertainties in the economy and healthcare, have become acutely conscious of system characteristics related to configuration scalability, clinical versatility and potential profitability.

Value-based PET/CT has gained increasing attention since the release of Philips’ Gemini LXL PET/CT system in 2010. It offers 16-slice CT, motion compensation via 4-D PET/CT and several high-end features at a highly competitive price-point. Siemens further fueled this trend in late 2010 with the launch of its Biograph mCT 20 Excel system, which made premium features, such as 20-slice CT, time-of-flight and a 78 cm bore available at a more affordable price. In early 2011, GE released the Optima PET-CT 560 system, offering 8- or 16-slice CT, an unprecedented scan range of up to 2 meters and full upgradeability to the company’s premium PET/CT platform, the Discovery PET/CT 600 series. It appears that the trend in value-based PET/CT will continue for some time with the launch of Philips’ TruFlight Select PET/CT system, another scanner offering time-of-flight and high-end performance at a price-point that fits the budget of more customers.

Frost & Sullivan enables clients to accelerate growth and achieve best-in-class positions in growth, innovation and leadership. It leverages 50 years of experience in partnering with Global 1000 companies. For more information: www.frost.com

July 31, 2024

July 31, 2024