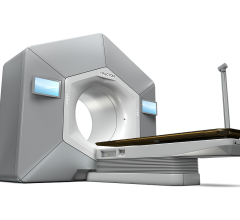

TomoTherapy Inc.'s Hi-Art

Linear accelerators typically last about seven years and can cost more than $2 million, but return many times more in cancer therapy revenue for busy outpatient imaging centers. Housed in specially built shielded bunkers, these nine-ton behemoths commonly referred to as “linacs” are the powerful, complex, multitasking engines of radiotherapy.

Linacs are the core of any external beam radiation therapy operation and are responsible for treating more than half of all cancers today. Their girth is eclipsed only by their level of sophistication: Linacs today provide the radiofrequency medicine behind such advanced imaging modalities as image-guided radiation therapy (IGRT) and emerging adaptive radiotherapy techniques that are treating cancers with unmatched precision.

Keeping Pace with Innovation

Linac technology, for the most part, has kept steady pace with the host of other innovations in imaging. Today’s machines incorporate multileaf collimators, allowing more precise dosage and radiation targeting.

Many with whom Outpatient Care Technology spoke believe linac technology took a quantum leap by integrating with cone beam computed tomography.

“This is without doubt the most significant innovation in linacs over the past five years,” said Chris Amies, Ph.D., vice president, Research and Clinical Collaboration, Siemens Oncology Care Systems Group. “In-room CT imaging gives the clinician the possibility to truly understand how changing anatomy may affect the quality of treatment. This information provides evidence that can be used to improve the quality of aggressive treatments.”

Such information gives clinicians more confidence in introducing complex techniques without adding more resources, Amies added, and may one day allow radiotherapy to be delivered more efficiently for some diseases, offering cost savings for providers and convenience to patients.

“External beam linear accelerators have made significant technological improvements in the last five years,” added Donald Goer, Ph.D., president, CEO and chief scientist for IntraOp Medical Corp., Sunnyvale, CA – among them online imaging and mechanisms that allow delivery of more conformal dose. “Diagnostic imaging and treatment planning technological improvements have enabled linear accelerators to provide these capabilities,” Goer said.

But no single imaging advancement has shaped linac technology more than three-dimensional modalities such as IGRT and intensity modulated radiation therapy (IMRT). Scant few linacs are even on the market today that don’t integrate with IMRT and are “almost a requirement” among outpatient imaging centers, noted Tony Richardson, director of Marketing for Ramsey, NJ-based Oncology Services International, a firm that sells refurbished linacs.

More recently, the emergence of IGRT has shaped new generations of linacs coming on to the market, and likely will be one of the major driving forces in linac innovation in the next few years.

The integration of IGRT with linacs allows image guidance to be supported with 2-D, 3-D, megavolt and kilovolt technology, according to Amies. In addition, he noted, motion management can now be addressed with new technologies such as respiratory gating, allowing for the development of adaptive strategies for each disease.

“These imaging innovations have made it possible for clinicians to treat cancers that they may not have treated before,” said Karla Knott, interim vice president for Global Marketing, Varian Medical Systems, Palo Alto, CA. “Essentially, precision has been enhanced, and the repercussions of that are still unfolding, as clinical researchers reexamine conventional protocols, including commonly-used dose prescriptions and fractionation schedules.”

Del Coufal, vice president, Marketing, for Madison, WI-based TomoTherapy Inc., also believes IGRT is the most significant innovation to shape linac technology in recent years. “IGRT took clinicians a huge step forward in making sure that the target is effectively radiated and the surrounding normal tissue is avoided,” he said. “Obviously, everyone’s goal is to cure all patients of cancer, but short of that is the desire to optimally manage the cancer patient for as long as possible.” So accurate has IGRT become that it is catching cancers previous therapies missed, he added. “These technological advances are giving rise to a growing segment of patients that come back for radiation therapy re-treatments because new tumor tissue can appear several years later,” he said.

“These innovations have no doubt changed the way radiation oncology is practiced today,” said Tim Prosser, business unit director, Delivery Systems, for Elekta Inc. “Physicians are able to see so many more things today they haven’t been able to see before.” Prosser proffers that Elekta pioneered IGRT for linacs, and was the first company to get a 3D image on a linac with a KV source during clinical trials at William Beaumont Hospital in Detroit. Prosser said Synergy, Elekta’s recently introduced IGRT platform for linacs, is the first of its kind to enable clinicians to image and treat patients simultaneously. Synergy provides automated workflow tools and 3-D volumetric imaging at the time of treatment.

On the financial side, IGRT capabilities have been a positive development for outpatient imaging centers because of a highly favorable reimbursement climate.

Key Features Buyers Seek

No doubt a linac may be the heaviest piece of equipment an imaging center will buy. The average weight is about 17,000 pounds. There are also real estate considerations. Linacs must be installed in specially shielded rooms. Noted Richardson: The cost of building a linac bunker, typically 40 square feet in size or greater, could be $500,000 or more.

According to the technology evaluation firm ECRI Institute, total capital outlays for equipment such as a multileaf collimator, record-and-verify computer system and electronic portal imaging system could run more than $1.8 million, while operating costs on a linac (which include salaries for physicist, techs and a service contract) could be as high as $485,000 the first year, and $440,000 each year thereafter.

Other costs to consider include:

• Hardware and software upgrades not covered by a service contract;

• Utilities;

• Other disposables and accessories, such as blocks, wedges, phantoms, and dosimetric equipment; and

• Contributions to overhead.

What’s driving buying decisions? “Outpatient centers are looking for a machine that combines flexibility, reliability and upgradeability,” said Amies. “The typical outpatient center treats a range of diseases and in many cases cannot justify more than one machine due to cost and patient load.”

Coufal concurred. “Certainly, outpatient centers have a lot of factors to consider when choosing a linac,” he said. “It’s obviously a substantial investment and it’s critical that the selected platform meet their needs today and several years down the road. What system a cancer center chooses is usually linked to how they see their clinical practice evolving.” Key evaluation criteria, he noted, should include the machine’s ability to treat a wide range of patients and tumor types, accuracy and precision, image guidance capabilities, clinical efficiency and workflow attributes and ease of use and system integration.

“Clinicians want what they have always wanted – reliable, user-friendly, automated technology that offers the best possible treatments for their patients,” added Knott. “That means the latest in beam shaping, image guidance, and dose delivery tools. They also want the purchase to be economical, meaning they want versatile machines that can treat more types of cancer very quickly so patients can get in and out for their treatments with no compromise in treatment quality.”

Here’s a look at some of the major features buyers seek in linacs today:

• State of the art – It might seem cliché, but imaging centers want linacs that are feature-rich and able to integrate the latest imaging techniques. Why? In a word, competition. “Physicians want their centers to be as competitive as possible by acquiring the newest and best technology,” said Richardson. “From a marketing point of view, this obviously makes sense. From a clinical standpoint, patients want to be serviced by a clinic that at least has the capability of high-tech radiation therapy if needed.” Goer agreed. “Buyers need to have equipment that is perceived by both professionals and consumers as being the most modern and accurate radiation delivery systems available,” he said.

• Automation, IT integration – Linacs today come with sophisticated on-board computers that allow the machines to integrate with modalities that produce massive amounts of images and data. Elekta’s Mosaiq Oncology PACS, for example, manages and archives data and images from many treatment systems, treatment planning systems and imaging devices – all within the context of individual patient charts. “A linear accelerator is not an island, but operates embedded in a web of important technologies for image guidance, motion management, and data processing,” said Knott. Many savvy buyers are realizing the importance of buying a linear accelerator that is well integrated with these other elements, including the treatment planning and oncology information systems.” Knott said such integration minimizes errors and the QA steps needed when operators transfer data between systems that are not integrated and drawing from a single database. “It also enables a clinic to implement dynamic adaptive radiotherapy processes, because information from the image-guidance system is immediately available for use with the treatment planning system in making revisions to a treatment plan,” she added.

• Upgradeability – In most cases, a new linac will last about seven to eight years before it becomes too old to keep up with changing medical practice or too expensive to repair. That’s why imaging centers demand machines that can easily be upgraded with the latest accessories and software. Major linac vendors, consequently, address this issue thoroughly. “The field is changing rapidly and new procedures are being developed within the normal lifecycle of a specific product,” said Amies. “Outpatient clinics need to maintain state of the art and provide access to complex treatments without purchasing new machines more often than every 7-10 years.”

• Reliability and productivity – In larger imaging centers especially, throughput is king, and it is not unusual for linacs to be churning and burning 12 hours or more a day. “Throughput is a major issue with outpatient centers,” said Prosser. “Radiation therapy is a volume business, and radiation therapists and physicists are in very short supply these days.” Prosser said a highly reliable linac is essential because most centers can ill afford to overwork trained staff, “so it’s important to have equipment that runs continuously, efficiently and doesn’t break down.” One recent Elekta innovation called volumetric modulated arch therapy (VMAT) allows a center to get more procedures done in a shorter period of time. Unlike IMRT, which shoots one angle at a time at each gantry stop, VMAT delivers beams in a continuous rotating arch. At this year’s American Society for Therapeutic Radiology & Oncology (ASTRO) conference, Elekta showcased Infinity, a new digital linac optimized for delivering VMAT. Varian recently unveiled RapidArc, which quickly delivers IMRT during a single rotation of the treatment machine around the patient while potentially conforming dose more closely to the size, shape and location of the tumor and sparing more surrounding healthy tissue. TomoTherapy’s Hi-Art system, which was designed around a CT ring gantry platform, continuously delivers IMRT from all angles around the patient by way of a helical fan-beam as the ring gantry rotates in simultaneous motion to the couch.

• Versatility – Many linacs today also are capable of doing double duty in radiation treatment and diagnostics. For example, Siemens’ CTVision reportedly brings powerful, high-contrast image-guidance to radiation treatment delivery by integrating a linear accelerator and a CT that travels along rails, enabling diagnostic imaging of the patient on the treatment table. For those centers that do cancer surgery, Intraop Medical Corp.’s Mobetron is a mobile and self-shielded linac designed for intraoperative radiotherapy treatment of cancer, coronary/vascular restenosis and other medical applications. Unlike other IORT systems, the Mobetron uses several patented technologies to allow IORT to be used without requiring shielding, Goer said. And as its name implies, the Mobetron can be moved between operating rooms.

• Maintenance – Service contracts are an essential part of the linac purchasing decision. And because of their size, complexity and workload, linacs require frequent fine-tuning, said Richardson. “Keeping the machines properly tuned requires monthly service,” he said. “As a service provider, we would expect a service engineer to be doing something to the machine on a weekly basis at a minimum.”

• Refurbished equipment considerations – For many new imaging centers, investing in a refurbished linac makes a lot of financial sense, say representatives from OSI. In many cases, the savings realized on a refurbished system purchase allows a center to invest in additional equipment and professional staff. “Freestanding surgery centers in rural areas with low patient volumes many times cannot afford the many millions of dollars for a new machine,” said Richardson, adding that OSI sells refurbished machines anywhere from $1 million-plus on the high end to $300,000-$500,000 on the low end. Moreover, reputable companies in the business sell machines refurbished according to original manufacturer specs, making them quite reliable.

June 14, 2024

June 14, 2024