Greg Freiherr has reported on developments in radiology since 1983. He runs the consulting service, The Freiherr Group.

Two Reasons Why CT Providers Shouldn’t Panic About XR-29

A low-dose standard for CT, set to take effect next year, is pushing many providers to upgrade or replace aging equipment. The scan underlying this image exposed the patient to 1.9 mSv. (Image courtesy of Siemens Healthcare)

More than one in three computed tomography (CT) sites surveyed by The Association for Medical Imaging Management (AHRA) could be subject to a 5 percent reimbursement penalty beginning next year. And that’s the best case. The number could be higher.

In August, when AHRA conducted the survey, 56 percent of respondents indicated they were not in compliance with XR-29, a standard designed to safeguard Medicare patients from excessive CT radiation; 36 percent replied they would not be compliant even by Jan. 1, 2016, the date this standard is scheduled to go into effect.

If XR-29 takes effect, as enacted under the Federal Protecting Access to Medicare Act of 2014, outpatient Medicare scans done using non-compliant scanners will be penalized 5 percent in 2016 and 15 percent the year after.

This threat is “currently driving a lot of new CT purchase activity,” an industry source told me earlier this week.

Here’s one reason not to panic. In the worst case scenario, which Eyal Aharon, CEO of Medic Vision, painted for me late last week, providers who delay purchasing new machines or upgrades a few months into next year will suffer only minimal losses — even if the new standard is implemented as scheduled.

“You do not have to stop operation on Jan. 1,” he said. “Maybe you’ll lose a couple thousand dollars but maybe you’ll save a lot more.”

Here’s the second reason. Groups including the AHRA, American College of Radiology, Radiology Business Management Association and American Hospital Association are pushing CMS for a delay. And there is reason to believe the implementation date could slip 12 or even 18 months. Why? Largely, because CMS has not yet issued a final ruling on the standard.

Up until a few days ago, CMS was still taking comments. Typically 90 days pass after the comment period closes until the Medicare agency issues a final ruling. That puts the release of the final ruling in mid-December — just a couple weeks before compliance is mandated.

“The capital budget cycle at hospitals is usually 18 months,” said Sheila M. Sferrella, who chairs the AHRA regulatory affairs committee. “In that type of planning cycle, there’s no way to allocate the capital for replacement equipment in time.”

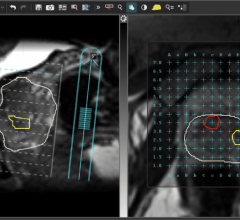

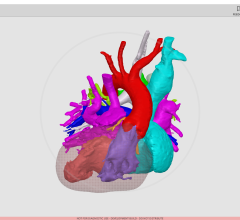

The major points of the proposed standard are not likely to change. These relate to dose tracking software that records dose in the patient record; software onboard the scanner that notifies staff about the dose before the scan; automatic exposure controls that tailor output; and reference protocols for specific types of exams.

But Sferrella said the final version needs a “modifier” to indicate whether an exam was performed on a non-compliant CT scanner. The law requires providers to report when such scans are done. The reporting and billing software now in widespread use, however, lack the ability to indicate the scanner used for a given examination, according to ACR comments submitted to CMS.

“It would be simple if you had only one machine, but most people have more,” Sferrella told me. Only 29 percent of the respondents in the AHRA survey said they operated just one CT scanner.

Providers need time to modify their workflow, as well as change software for PACS, RIS and billing, according to the ACR comments.

Even if CMS doesn’t buy this argument and the ruling takes effect the first of next year, the penalties for noncompliance will be modest compared to overall revenue. This is why Medic Vision CEO Aharon thinks providers shouldn’t feel rushed to make a decision. Here’s the math:

Say an outpatient site does 20 scans per day, six days a week. That’s 480 a month. Maybe half are done on Medicare patients. Because the proposed rule covers about 90 percent of the types of CT scans, 216 scans at this site will be noncompliant. Figure a Medicare charge of $200 per scan — minus the $10 penalty (5 percent). This site, therefore, will earn $41,040 per month from Medicare scans, while missing out on revenues of $2,160 due to noncompliance.

In comparison, brand new radiological CT scanners that comply with the scanner can be bought for between $300,000 and $400,000. That does not include the quarter- to half-million dollars in site improvements their installation will require, according to Sferrella. Even upgrades, she said, can cost between $20,000 and $200,000.

“So I’m telling people to wait until the final CMS ruling comes out later this year,” Aharon said.

Editor’s note: This is the second blog in a series of four by industry consultant Greg Freiherr on CT systems. The first blog in this series, “Three Ways CT Will Radically Change — When and How,” can be found here.

August 09, 2024

August 09, 2024